Economic Week - November 1

By Nick Clark

Farm debt squeezed…

Agricultural debt fell in September, according to the Reserve Bank’s monthly Sector Lending Statistics.

Agricultural debt was $63.7 billion, down $97 million on August and down nearly $200 million on July. Despite these recent falls, the sector’s debt was still up $1,462 million, or 2.4%, for the year. A slowing in the annual growth of debt has been evident since May when it was 4.0%.

Annual growth in debt for housing (up 6.5%) and business (up 6.0%) both continue to be faster than that for agriculture, while personal consumer debt continues to be flat (up 0.1%)

…As Farm Debt Mediation Bill progresses…

Agricultural debt is likely to continue to be squeezed down as banks require farmers to pay down debt run up over recent years. This squeeze, and the pressure being put on some farmers, highlights the need for the Farm Debt Mediation Bill, which was this week reported back to the House by the Primary Production Select Committee.

A number of changes have been made to the Bill, most of which appear to be farmer-friendly and in some cases specifically addressed concerns Federated Farmers raised in its submission, for example…

- The problem where banks could decline farmers’ requests for mediation prior to a bank taking enforcement action has been addressed by adding a requirement that creditors must accept an earlier request for mediation by a farmer unless they have good reason to decline.

- Clarification that mediation processes need to be able to cater for multiple parties.

- The farmer share of mediators’ cost to be capped at $2,000 (originally it was to be a 50:50 share).The farmer is still expected to meet his/her own cost though.

One issue where the banks were heard was for situations of urgency (e.g., animal welfare, crop wastage, environmental non-compliance, misappropriation of assets) where despite there being a restriction in enforcement action a secured creditor will be able to apply to the High Court to allow them to appoint a receiver but the Court would need to be satisfied that the situation is urgent.

We didn’t get everything we asked for. For example, the Bill continues to not require mediators to have to be qualified and experienced in the agricultural and rural sectors – although we will have the opportunity to ensure MPI sets out these as criteria when approving mediation organisations. And we would have preferred an independent body to appoint mediators rather than banks selecting a person from a list of mediators provided by the farmer.

…And Banking Survey opens

The squeeze in debt also highlights the continued need for Federated Farmers to monitor farmers’ relationships with banks. To this end, Federated Farmers members should receive an email today inviting them to participate in the November 2019 Banking Survey. Please take a few minutes to let us know how things are going.

Is the Government’s surplus gone already?

After a monster $7 billion fiscal surplus for the last financial year, the outlook isn’t looking quite so flash for this year.

The Government’s financial statements for the three months to 30 September 2019 have been released and they show an operating deficit before gains and losses of $593 million. This was $1.6 billion below a forecast surplus of $1.0 billion, primarily due to lower than expected tax revenue.

Core Crown tax revenue of $20.4 billion was $1.5 billion (6.8%) below forecast. Lower company tax revenue is the main reason of this variance but Treasury expects much of this to be timing related and expects it to reverse out during the year. Meanwhile Core Crown expenses of $22.7 billion were close forecast.

Net Core Crown debt was $60.8 billion (20.3% of GDP) at the end of September 2019, $2.1 billion less than forecast. The lower than expected net debt position is largely due to a stronger than expected opening position at the start of the year.

Does this early update mean we won’t have a surplus this year? On the one hand this was always a risk. After making big spending increases in Budget 2019, a reduced $1.3 billion surplus was forecast for the coming year and even this small-ish surplus was predicated on strong economic growth pulling in more tax revenue.

Tax revenue was down for the first three months, especially from company tax, but tax flows can be volatile and IRD’s computer upgrade has changed the timing of the recognition of tax payments. It will take a few more updates before it becomes clear how much the slowing economy will impact upon tax revenue and whether we get a surplus this year.

The Government’s overall fiscal position, particularly net debt, also continues to be strong but what this early update does show is that last year’s big surplus is history and we can’t assume a repeat. There is likely to be less room to splurge than some commentators think.

Business confidence mixed

ANZ’s latest monthly Business Outlook Survey for October 2019 showed a recovery of sorts in headline confidence but a continued slippage in expectations for own activity.

First the good news – relatively speaking! A net 42.4% of businesses expected general economic conditions to worsen over the coming 12 months, an 11 point improvement on September’s net 53.5%. For agricultural respondents a net 61.0% expected a worsening in conditions, a 15 point improvement on last month but still at deeply pessimistic levels.

Own activity is a better predictor for economic growth and the story here is more concerning. Overall, a net 3.5% of businesses expected their activity to reduce, a 1.7 point slippage on September. For agricultural respondents a net 4.9% expected their activity to reduce, a 2.5 point worsening on last month.

More businesses and employees

New Zealand had 546,740 businesses employing 2.3 million people as at February 2019, according to Statistics NZ’s annual Business Demography Statistics. Compared to February 2018 the number of businesses was up 1.8% and the number of employees was up 2.1%.

As at February 2019 there were 53,454 agricultural businesses (down 0.5%) employing 85,400 people (up 0.8%), of which:

- 15,189 dairy cattle farms (up 1.7%) employed 25,700 people (down 0.4%); and

- 23,817 sheep, beef cattle and grains farms (no change) employed 20,600 people (up 0.5%).

The number of employees does not include self-employed owner-operators, which is why there are more sheep, beef cattle and grains farms than people employed on those farms.

Since 2000 the number of dairy cattle farms has dropped by around 6,000 but the remaining farms employ nearly 11,000 more people. Meanwhile the number of sheep, beef cattle and grains farms has dropped by nearly 8,000 and the remaining farms employ nearly 5,000 fewer people.

Building consents strong

Statistics NZ’s monthly Building Consents Issued statistics show that in September 2019 the seasonally adjusted number of new dwellings consented rose 7.2% compared to August 2019. There was particularly strong growth for apartments and other higher density homes.

In the year ended September 2019, the actual number of new dwellings consented was 36,446, up 12.0% on the September 2018 year. This is the highest annual number since October 1974, but is still well below the February 1974 peak of 40,025.

The annual value of non-residential building work consented was $7.6 billion, up 12.7% for the year. However, the annual value of farm buildings consented was down 7.8% to $320 million.

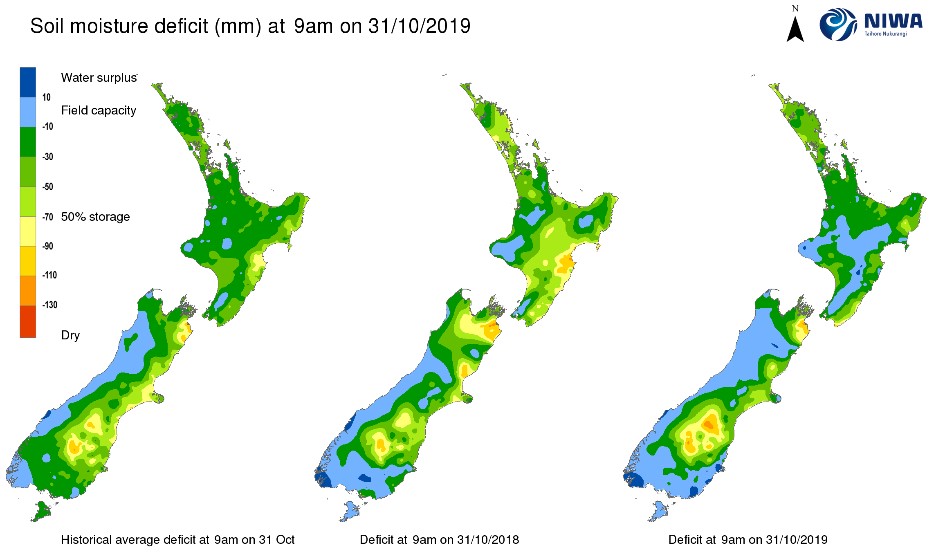

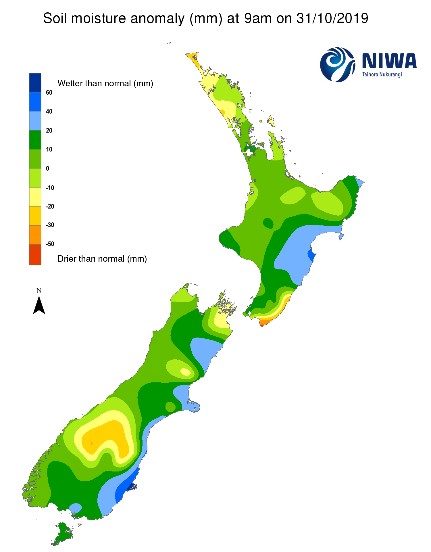

NIWA Soil Moisture Data

NIWA’s latest soil moisture maps (as at 9am Thursday 31 October) show much of the east coasts of both islands wetter than usual, with the exception of coastal Wairarapa. The Far North and Central Otago are also dryer than usual.

Exchange Rates

Overall, the NZ Dollar was down for the week against the TWI and down against most of our key trading partners, especially the Australian Dollar where it lost almost a cent. The exception was the Japanese Yen, where there was a small gain, while the US Dollar and UK Pound were almost unchanged.

|

NZ Dollar versus

|

This Week

(31/10/19)

|

Last Week (24/10/19)

|

Last Month (30/9/19)

|

Last Year (31/10/18)

|

|

US Dollar

|

0.6414

|

0.6417

|

0.6277

|

0.6551

|

|

Australian Dollar

|

0.9277

|

0.9374

|

0.9287

|

0.9259

|

|

Euro

|

0.5746

|

0.5765

|

0.5739

|

0.5776

|

|

UK Pound

|

0.4966

|

0.4969

|

0.5106

|

0.5156

|

|

Japanese Yen

|

69.77

|

69.71

|

67.73

|

74.18

|

|

Chinese Renminbi

|

4.5270

|

4.5396

|

4.4691

|

4.5602

|

|

Trade Weighted Index

|

70.83

|

71.09

|

70.23

|

72.36

|

Source: Reserve Bank of NZ

Wholesale Interest Rates

Over the course of the week 90 Day Bank Bill interest rate rose 5 basis points while the rate for 10 Year Government Bonds rose 1 basis point. The OCR is next reviewed on 13 November.

|

|

This Week

(31/10/19)

|

Last Week (24/10/19)

|

Last Month (30/9/19)

|

Last Year (31/10/18)

|

|

OCR

|

1.00%

|

1.00%

|

1.00%

|

1.75%

|

|

90 Day Bank Bill

|

1.10%

|

1.05%

|

1.15%

|

1.91%

|

|

10 Year Government Bond

|

1.29%

|

1.28%

|

1.10%

|

2.54%

|

Source: Reserve Bank of NZ