Economic Week - December 21

by Nick Clark

A bumper week of Christmas goodies for the economically minded!

Growth softens

Economic growth softened during the September quarter, according to Statistics NZ’s Gross Domestic Product statistics.

GDP expanded by 0.3% in the September 2018 quarter, well down on the June quarter’s growth of 1.0% and well below most forecasts of around 0.6%. It was also the slowest quarter since December 2013 and meant that GDP per capita was flat.

Growth was mixed, with 11 of the 16 industries recording higher production, including agriculture, forestry, and fishing which was up 0.8%. However, although forestry grew, agricultural production was down and associated with this food manufacturing was also down.

For the year to September 2018, GDP grew by a still respectable 3.0%, with agriculture, forestry and fishing up 2.1%.

The NZ Dollar fell sharply after the slower than expected result.

GDT up

The Global Dairy Trade ended 2018 with a modest gain, rising 1.7% in this week’s auction, but undershooting some economists’ expectations.

Almost all the commodities on offer increased in price, the exception being rennet casein, which fell 2.1%. Whole milk powder, by far the biggest commodity by volume, could only eke a slim 0.3% gain, which dragged the overall result down. Others did better though, including skim milk powder (up 3.4%), anhydrous milk fat (up 4.0%), butter (up 4.9%), cheddar (up 2.2%), and lactose (up 1.6%).

The average winning price was $US2,844 and 36,181 tonnes of product were sold.

Despite the last two auctions of 2018 posting gains, the GDT is still down 6.0% compared to the final auction of 2017. This is a legacy of the six-month run of falls from May to November.

Confidence improves

Business confidence lifted in December, but not for farmers, according to ANZ’s monthly Business Outlook Survey.

A net 24.1% of businesses believe general economic conditions will worsen over the coming year. This is a 13-point improvement on November but it’s still in deeply negative territory. In contrast to other sectors agricultural respondents’ sentiment deteriorated 9.5 points to a dismal net 65.4% expecting conditions to worsen. Agriculture is by far the most negative sector about the economy.

Businesses also felt better about their own-activity, up 6 points to a net 13.6% expecting it to increase over the coming year. For agriculture there was also an improvement of 4.6 points to a net 10.3% expecting their own activity to increase – opening a huge gap against sentiment about the economy. Retail was the least optimistic sector for own activity with only a net 1.9% expecting it to increase.

According to ANZ, although agriculture’s own activity is looking up there are “a combination of factors affecting agricultural sentiment: costs are rising (feed, fertiliser, transport, etc), environmental regulation is tightening, and there is wariness about the state of the global economy and hence the outlook for commodity prices.” This also follows are very negative Rabobank Rural Confidence Survey published two weeks ago which made similar points.

Federated Farmers’ next six-monthly Farm Confidence Survey will be undertaken in the new year. Feds members, keep an eye out for your invitation to participate.

Ag Debt

Agricultural debt rose to $62.5 billion in November, according to the Reserve Bank’s monthly Sector Lending Statistics. This was up $201 million (or 0.3%) for the month and $1.9 billion (or 3.0%) for the year.

The annual growth in agricultural debt for the year to November of 3.0% has accelerated a little from the 2.8% growth recorded for the year to October. However, it is still slower than the rates of growth for the housing (6.1%), personal consumer (3.6%), and business (4.5%) sectors.

Farm sales lift

After a slow start to spring farm sales lifted in November, according to the Real Estate Institute of NZ’s Rural Market Statistics. There were 336 farm sales in the three months to November 2018, up 27.8% on the three-month period to October and up 6.3% on the same three-month period last year.

On an annual basis, 1,486 farms were sold in the year to November 2018. This was 5.9% fewer than were sold in the year to November 2017 but it was a smaller rate of decline compared to previous months. Dairy farms were down 11.2%, grazing farms were down 2.8%, finishing farms were down 3.2% and arable farms were down 12.6%.

Exports up

Exports rose in November, but imports remained strong, according to Statistics NZ’s monthly Merchandise Trade Statistics.

Goods exports were worth $4.9 billion in November 2018, up $326 million (or 7.1%) on November 2017. Exports of milk powder, butter, and cheese rose $30 million (or 2.1%) to $1.5 billion, while meat rose $56 million (or 11.2%) to $553 million. Wool exports were down $6 million (or 9.0%) to $59 million.

Goods imports were little changed, down 0.6% to $5.8 billion. This was the seventh consecutive month with import values over $5 billion, and the fourth-highest total on record. The net result was a monthly trade deficit of $861 million.

For the year ended November 2018 goods exports were worth $57.5 billion, up 9.5% on the previous year. Exports of milk powder, butter, and cheese were worth $14.4 billion (up 5.9%) and meat exports were worth $7.5 billion (up 17.4%). Wool exports were up 12.0% to $574 million.

Goods imports were worth $63.0 billion for the year, up 12.4% on the previous year. The net result was an annual trade deficit of $5.4 billion, nearly $2 billion bigger than that for the year to November 2017.

Balance of Payments

The annual current account deficit widened in the September 2018 quarter to $10.5 billion or 3.6% of GDP, according to Statistics NZ’s quarterly Balance of Payments and International Investment Position. This was up from 3.3% in the June quarter and 2.7% in September 2017. It is now in line with its historical average.

For the September quarter, the unadjusted current account balance pushed deeper into deficit. This is typical for a September quarter where goods exports fall thanks to the seasonal nature of agricultural production. The services balance also dipped into deficit, thanks to the many New Zealanders who go on overseas holidays to escape winter and the seasonal lull in inbound tourists. When seasonally-adjusted the current account deficit narrowed slightly.

New Zealand’s net international liability position also rose slightly to 53.7% of GDP.

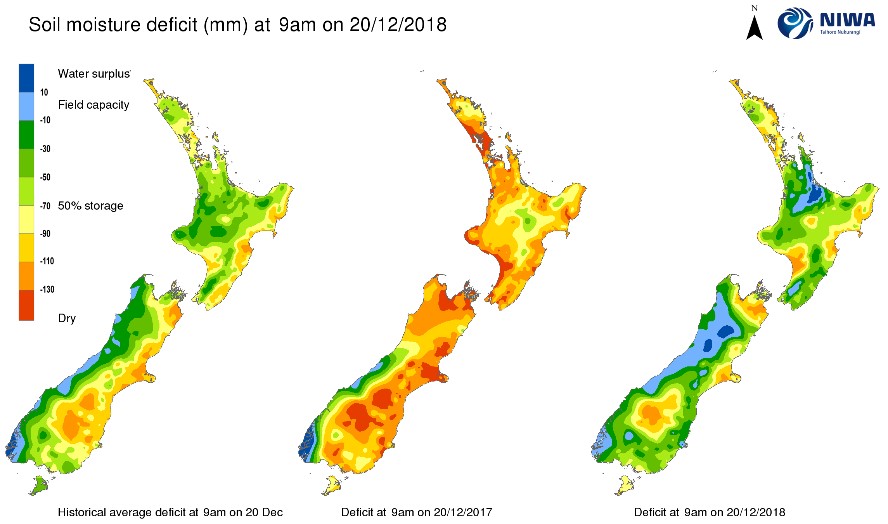

NIWA Soil Moisture Data

NIWA’s latest soil moisture maps (as at 9am Thursday 20 December) continue to show Bay of Plenty and much of the east coasts of both islands are wetter than usual, while much of the west coasts are about average or dryer than usual. The contrast with the same time last year is striking.

Exchange Rates

The reaction to the slower than expected September quarter GDP pushed the NZ Dollar down. Over the course of the week the NZ Dollar was down against the Trade Weighted Index and was also down against most of our main trading partners, except the Australian Dollar where it was up slightly.

|

NZ Dollar versus

|

This Week

(20/12/18)

|

Last Week (13/12/18)

|

Last Month (20/11/18)

|

Last Year (20/12/17)

|

|

US Dollar

|

0.6778

|

0.6854

|

0.6843

|

0.6979

|

|

Australian Dollar

|

0.9516

|

0.9495

|

0.9386

|

0.9110

|

|

Euro

|

0.5954

|

0.6028

|

0.5977

|

0.5893

|

|

UK Pound

|

0.5369

|

0.5432

|

0.5323

|

0.5211

|

|

Japanese Yen

|

76.26

|

77.69

|

77.04

|

78.82

|

|

Chinese Renminbi

|

4.6734

|

4.7214

|

4.7506

|

4.6113

|

|

Trade Weighted Index

|

74.34

|

75.03

|

74.74

|

73.72

|

Source: Reserve Bank of NZ

Wholesale Interest Rates

Both the 90-day Bank Bill rate was unchanged for the week but the 10 Year Government Bond rate was down 9 basis points. The OCR has been unchanged on 1.75% since November 2016.

|

|

This Week

(20/12/18)

|

Last Week (13/12/18)

|

Last Month (20/11/18)

|

Last Year (20/12/17)

|

|

OCR

|

1.75%

|

1.75%

|

1.75%

|

1.75%

|

|

90 Day Bank Bill

|

1.97%

|

1.98%

|

2.00%

|

1.86%

|

|

10 Year Government Bond

|

2.39%

|

2.48%

|

2.69%

|

2.75%

|

Source: Reserve Bank of NZ

Merry Christmas!

The Feds weekly economic update will take a break over the holiday period. It will be back on Friday 18 January. In the meantime, have a merry Christmas and a happy New Year.