Economic Week - August 3

by Nick Clark, Manager General Policy

Farmer confidence a mixed bag

Farmers’ confidence in general economic conditions has slipped, but they are more upbeat about their own prospects, according to Federated Farmers’ July 2018 New Season Farm Confidence Survey.

Confidence in the general economy slipped 5 points compared to the previous survey undertaken in January 2018, to a net 39% expecting conditions to worsen. This is similar to other recent business confidence surveys.

However, unlike the other surveys’ slippages in expectations for ‘own activity’, the Farm Confidence Survey showed improvements for forward looking indicators of farm profitability (up 10 points), farm production (up 16 points), farm spending (up 2.5 points), and farm debt (down 6 points).

Recruitment has continued to be difficult with the difference between those finding it harder and those finding it easier widening to its biggest gap since the survey began in 2009.

The biggest issues of concern for farmers were regulation and compliance costs; pests, diseases and biosecurity; climate change policy and ETS; and the political situation.

The highest priorities farmers had for the government were biosecurity; economy and business environment; fiscal policy; and regulation and compliance costs.

Federated Farmers would like to thank the 1,113 farmers who completed the survey in early July. The next survey will be undertaken in January 2019, the middle of the season.

Business confidence in free fall

Overall business confidence has continued its downward spiral, according to ANZ’s July Business Outlook Survey. The latest monthly survey showed a net 44.9% of respondents expecting general economic conditions to worsen over the coming year, down 5.9 points on June’s already dismal result and down to its lowest point since May 2008.

Much has been said about the greater importance of the survey’s own-activity indicator for predicting GDP but even this points to bad news. It fell 5.6 points to just a net 3.8% expecting their own activity to increase over the coming year. This is worst result since May 2009 when the economy was in recession following the Global Financial Crisis.

Retailers are particularly gloomy about their own prospects, with construction not much better. Agricultural respondents weren’t so bad – relatively speaking. A net 8.3% expect their own activity to increase (down 1.7 points), while a net 44.1% expect the general economy to worsen over the coming year (down 6.6 points on June), similar to the overall result for all businesses.

Labour market stable

The labour market remained solid in the June quarter, according to Statistics NZ’s Labour Market Statistics.

Employment continued to grow, up 0.5% during the quarter and 3.7% compared to June 2017. Labour force participation also remained at historically-high levels, up to 70.9%. More people in the labour force was the main reason for a small increase in the unemployment rate from 4.4% to 4.5%.

April’s increase in the minimum wage boosted wage inflation, with the Labour Cost Index up 0.5% for the quarter and up 1.9% for the year. However, putting aside the minimum wage increase and last year’s aged care settlement, there aren’t many signs of more generalised wage inflation.

Injuries stable

In 2017 there were 23,900 ACC work-related injury claims in the agricultural sector, according to Statistics NZ’s Injury Statistics. This was up slightly on the 23,300 recorded for 2016 but broadly stable when looking at the five years 2012-17.

The incidence rate (that is the number of claims per full-time equivalent) for the agriculture, fishing and forestry sector is still almost double that of the overall economy (186 versus 101). Also, people aged over 75 have a rate almost double that of overall population (190 versus 101). 30% of all claims for the over 75s were in the agriculture, fishing and forestry sector.

Building consents slip in June

There were 2,792 residential building consents issued in June 2018, down on May but still up 9.1% on June 2017, according to Statistics NZ’s monthly Building Consents statistics. For the year ended June 2018 32,860 new dwellings were consented, up 7.9% on the previous year.

Meanwhile, 18 farm buildings were consented in June 2018. This was down on June 2017’s 21 buildings but for the whole year to June 2018, 351 farm buildings were consented, up a whopping 50.6% on the previous year. The large annual increase was influenced by particularly strong months in January (44) and February (59).

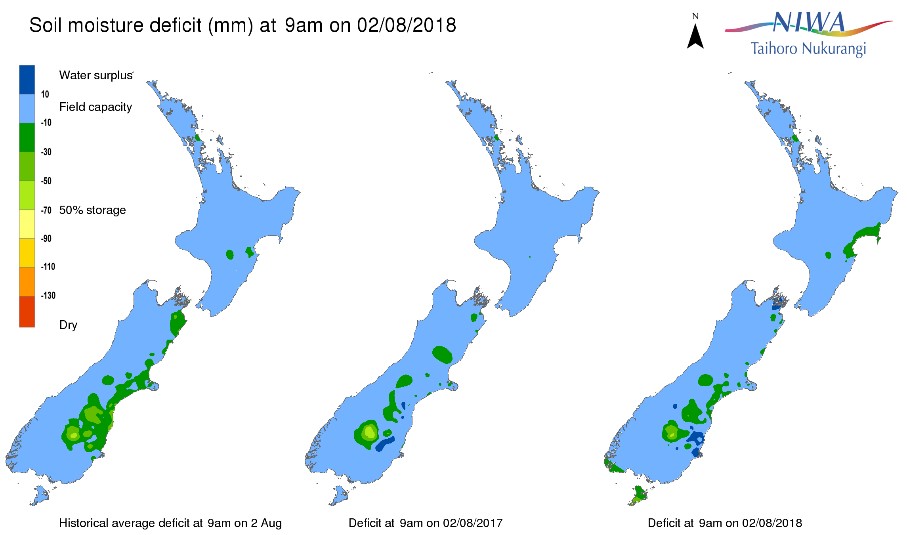

NIWA Soil Moisture Data

NIWA’s latest soil moisture maps (as at 9am Thursday 2 August) continue to show most of the country around average.

Exchange Rates

|

NZ Dollar versus

|

This Week

(2/8/18)

|

Last Week (26/7/18)

|

Last Month (2/7/18)

|

Last Year (2/8/17)

|

|

US Dollar

|

0.6792

|

0.6839

|

0.6780

|

0.7419

|

|

Australian Dollar

|

0.9177

|

0.9182

|

0.9168

|

0.9339

|

|

Euro

|

0.5823

|

0.5828

|

0.5815

|

0.6288

|

|

UK Pound

|

0.5176

|

0.5181

|

0.5142

|

0.5622

|

|

Japanese Yen

|

75.78

|

75.79

|

75.25

|

82.03

|

|

Chinese Renmimbi

|

4.6259

|

4.6172

|

4.4969

|

4.9910

|

|

Trade Weighted Index

|

73.23

|

73.41

|

72.65

|

78.26

|

Source: Reserve Bank of NZ

Wholesale Interest Rates

|

|

This Week

(2/8/18)

|

Last Week (26/7/18)

|

Last Month (2/7/18)

|

Last Year (2/8/17)

|

|

OCR

|

1.75%

|

1.75%

|

1.75%

|

1.75%

|

|

90 Day Bank Bill

|

1.91%

|

1.91%

|

1.99%

|

1.96%

|

|

10 Year Government Bond

|

2.82%

|

2.81%

|

2.85%

|

2.99%

|

Source: Reserve Bank of NZ