Economic Update

July 6, 2018

by Nick Clark

Business confidence plunging the depths – again

Business confidence – or the lack of it – has been grabbing headlines. Last week it was the ANZ Business Outlook Survey and this week it was the turn of NZIER’s

Quarterly Survey of Business Opinion.

The June quarter QSBO showed a net 19% of businesses expecting a deterioration in economic conditions, down 9 points on the March quarter’s already pessimistic score.

Firms’ views of their own trading activity, a better indicator for economic growth, remained positive but softened to a net 7% expecting higher activity.

The QSBO, which is closely watched by the Reserve Bank and other economic policy makers, showed higher costs impacting on profitability and businesses more cautious about investment although hiring intentions are holding up.

The QSBO does not include agriculture but includes the sectors which do business with farmers. The retail sector was especially downbeat, which was also a feature of last week’s ANZ survey. Taranaki, Otago and Marlborough were the most pessimistic regions.

Overall, the survey points to softer growth in the second half of 2018 but a pick-up in inflationary pressures. This is not a great combination. The Government’s policy direction and related uncertainty is a key problem for businesses and is something it needs to work on if the economy isn’t to stall.

Farm confidence slips too

Rabobank’s June quarter

Rural Confidence Survey has shown a drop in farmer confidence on the back of Mycoplasma bovis.

The survey found the number of farmers expecting the rural economy to improve in the next 12 months was down 1 point to 26%, while the number expecting the rural economy to worsen rose 12 points to 24%. 46% expected similar conditions, down 13 points. The net result was a +2% confidence level, down from +15% in the March quarter.

High commodity prices were cited as a reason for confidence remaining net positive. Most of those who thought rural economy would worsen cited Mycoplasma bovis but interestingly the net confidence levels by sector rose slightly for dairy farmers and dropped for sheep and beef farmers and horticulturalists.

Farmers’ expectations for their own farm business performance in the coming 12 months, also dipped seven points to +29%. Horticulturalists continued to have the most positive outlook about the performance of their own business, with dairy sentiment up but sheep and beef was down.

Time to have your say - Farm Confidence Survey

Meanwhile, Federated Farmers’ six-monthly Farm Confidence Survey is currently in the field. Federated Farmers members should keep an eye out for the email invitation to take the survey. Respondents can go into a draw for an Air New Zealand Mystery Break.

Winter shiver for commodity prices

The

ANZ Commodity Price Index slipped 1.0% in June, a correction after five consecutive monthly increases, and taking the year-on-year increase down to 2.2% (from 5.4% in May).

Prices fell across all broad categories, apart from seafood which was flat. Dairy prices slipped 1.0% for the month, partially cancelling out last month’s 1.5% rise. Meat and wool prices were down 0.8% overall. This was due to a 2.8% drop in beef prices while lamb prices rose 1.1% and wool prices were up 0.6%. It is encouraging to see wool prices recovering, up 19.5% compared to the same time last year.

The NZ Dollar had its ups and downs during June but ended up appreciating against all major trading partners except the US Dollar. This resulted in the NZD Index slipping 1.1% for the month, although it was still up a healthy7.4% for the year.

GDT down again

Dairy prices dropped again in this week’s

Global Dairy Trade auction as the market digests higher than previously expected New Zealand milk production and other global supply and demand factors.

The GDT Price Index dropped 5.0%, with most products posting falls. Whole milk powder suffered a particularly steep decline, slumping 7.3%, while skim milk powder retreated 4.6%, cheddar was down 4.3% and butter was down 4.0%.

Overall, the average selling price was $US3,232 and 26,519 tonnes were sold.

The GDT Price Index has now fallen in eight of the last 10 auctions and it is down 8.9% on the same time last year. However, a lower NZ Dollar against the US Dollar should be helping to soften the impact at the farmgate.

Ag debt rises

Agricultural debt grew by $245 million in May to reach $61.0 billion according to the Reserve Bank’s monthly

Sector Lending Statistics. This was up $1.6 billion (or 2.5%) on May 2017.

The other sectors’ debt grew faster than agriculture’s 2.5%, but their annual growth rates have slowed. Housing debt was up 5.9% year-on-year, personal consumer debt was up 6.4%, and business debt was up 5.3%.

Businesses had a good 2017

Business profitability for the 2017 financial year was the best since the Global Financial Crisis, according to Statistics NZ’s

Annual Enterprise Survey. Overall, business assets increased to almost two trillion dollars and businesses made a return on investment of 4.4%. The average since 2009 has been 3.4%.

2017 was a relatively good year for business profitability and that’s good news. However, the data comes from businesses’ balance dates between 1 October 2016 and 30 September 2017, so it is largely historic and reflects a different environment.

Since then business confidence has slumped and concern has risen about profitability. Will 2017’s 4.4% return on investment may be as good as it gets.

Books in good shape

The latest

Government Financial Statements for the 11 months to May 2018 showed an operating surplus of $5.2 billion, 9.3% above the Budget forecast.

Core Crown revenue of $73.5 billion was close to forecast while core Crown expenses of $73.0 billion was a little under forecast. Net core Crown debt came in at $57.5 billion, $1.1 billion lower than forecast. As a percentage of GDP, net debt was 20.1%, a little lower than the forecast of 20.4%.

Some of the variances from forecasts were due to timing issues but nevertheless the books for the full year to June 2018 should look rosy. All will be revealed when the full year financial statements are revealed in October.

The Government’s fiscal forecasts of rising surpluses and falling debt to GDP over the next few years are based on strong economic growth but with the economy slowing and confidence down those forecasts could prove to be overly optimistic.

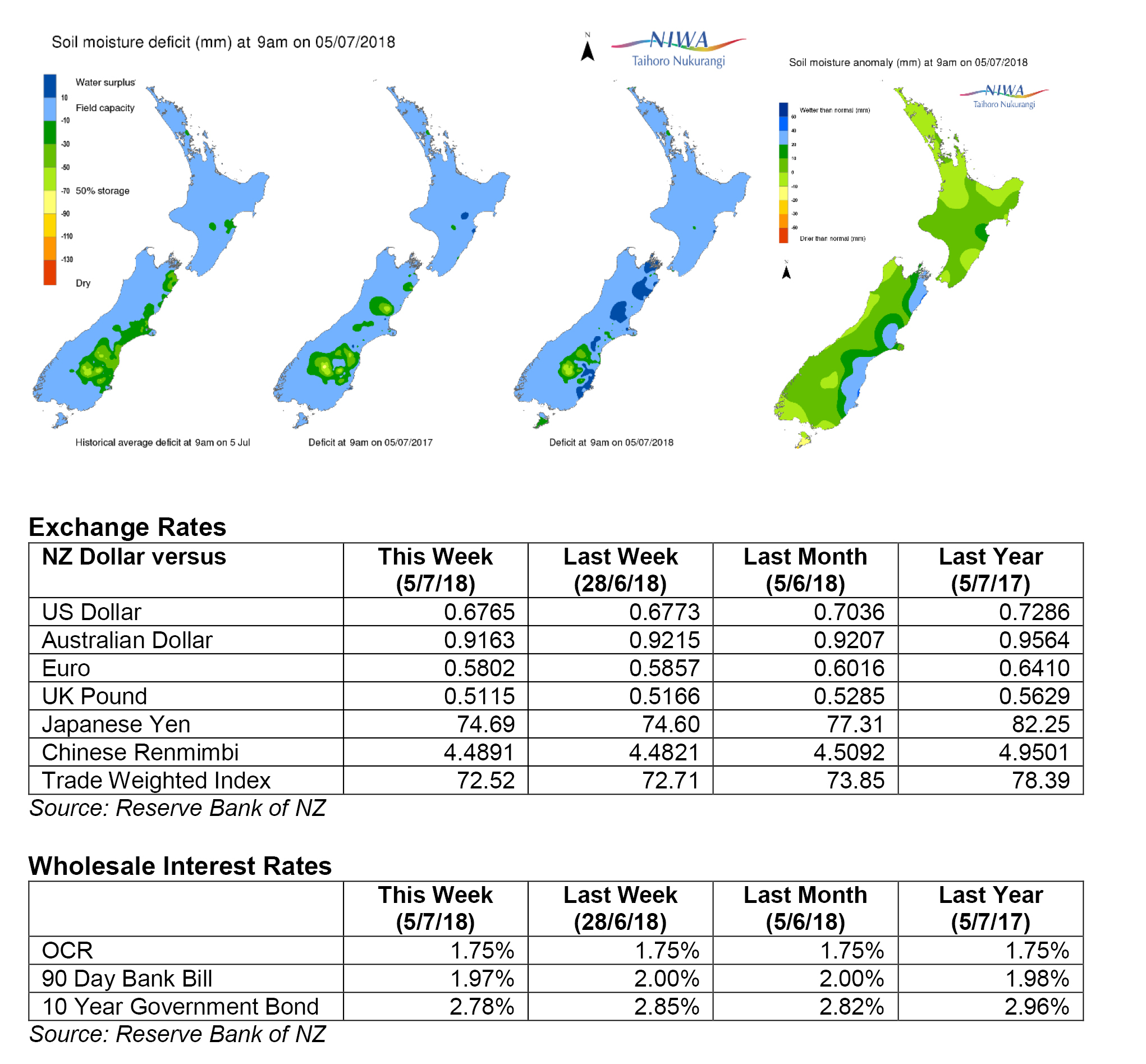

NIWA Soil Moisture Data

NIWA’s latest

soil moisture maps (as at 9am Thursday 5 July) continue to show most of the entire country either around average or wetter than usual at this time of year.