Economic Week - June 15

by Nick Clark

Bumper year for primary industries

Primary sector exports for the year to June 2018 are shaping up to be the best since 2014 according to the Ministry for Primary Industries’ Situation & Outlook for Primary Industries (SOPI).

SOPI forecasts primary sector exports of $42.6 billion for 2017/18, up $4.5 billion (or 11.8%) on 2016/17. This will take primary sector exports above their previous peak of $38.6 billion in 2013/14.

Dairy exports are expected to contribute $16.6 billion in 2017/18 (up 13.6%), meat and wool $9.4 billion (up 12.4%), forestry $6.4 billion (up 15.8%), and horticulture $5.5 billion (up 6.4%). Arable is also forecast to be up 11.7% to $220 million.

Looking ahead to 2021/22, primary sector exports are forecast to increase steadily to $46.1 billion. Forestry exports are expected to be static and meat and wool to increase only slowly, but the other industries, including dairy, are expected to grow at respectable rates.

Thanks to the vagaries of the weather, international commodity prices, and exchange rates, it is fiendishly difficult to forecast primary sector export volumes and values one year out let alone four years out.

However, despite these vagaries, the immediate challenge posed by Mycoplasma bovis, and more longer-term risks of climate change, biosecurity, and alternative proteins, SOPI portrays a reasonably positive outlook for the primary industries.

Food prices flat

Food prices fell by a seasonally adjusted 0.1% in May, according to Statistics NZ’s monthly Food Price Index. Fruit & vegetable prices fell 2.0%, despite a headline grabbing 37% increase for avocados due to a small harvest. Meat, fish and poultry prices were up 0.8%, with mutton, lamb & hogget up 7.2% but beef and veal down 2.6%. Grocery food prices were down 0.3%, with bread and cereals down 0.3% and milk, cheese and egg prices down 0.1%.

On an annual basis food prices were down 0.1%. Fruit & vegetable prices exerted the main downward influence, falling 10.2% from a weather-influenced high point this time last year. But avocados again bucked the overall movement, up 50% for the year. Meat, poultry and fish prices were up 0.6% for the year, with mutton, lamb and hogget up 8.5% and beef and veal down 3.5%. Grocery food prices were up 0.4%, with bread and cereals down 0.9%, and milk cheese and eggs also down 0.9%.

Retail sales slow

After falling sharply in April, retail card spending nudged back up May, according to Statistics NZ’s Electronic Card Transactions. The 0.4% month-on-month increase was led by consumer spending on household essentials such as groceries and fuel. Other sectors had a quiet month.

On an annual basis retail card spending was up 4.2%.

House prices set new record

Monthly housing market statistics for May 2018 from the Real Estate Institute of NZ show a year-on-year price increase of $27,000 to a new record median house price of $562,000.

Median prices for New Zealand excluding Auckland increased by 5.8% to $455,000, up from May 2017’s $430,000. However, Auckland’s median price decreased 1.3% from the same time last year, with May 2018 seeing a price of $852,000 (down from $862,800).

West Coast (up 25.7%), Tasman (up 16.2%) Otago (up 14.6%), and Manawatu-Wanganui (up 13.0%) had the biggest annual increases in median house prices. As well as Auckland, two other regions had annual decreases – Gisborne and Southland.

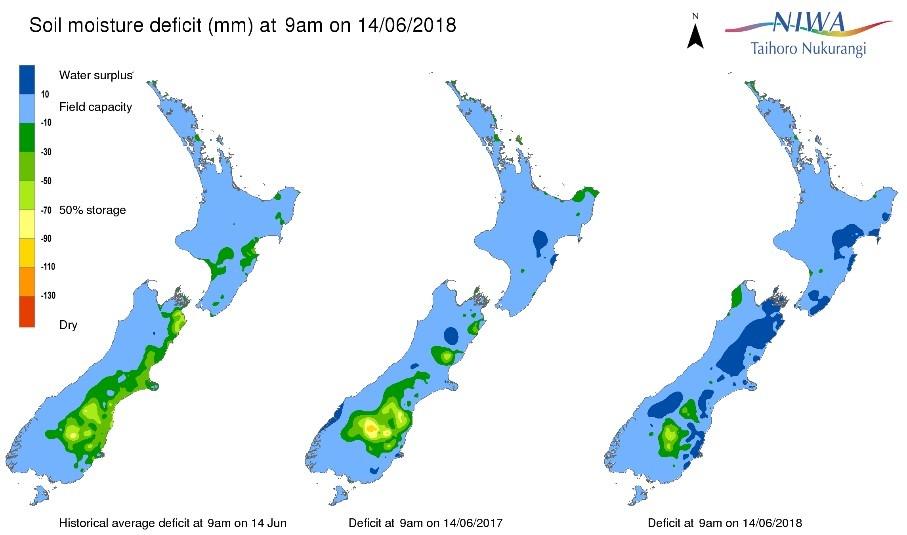

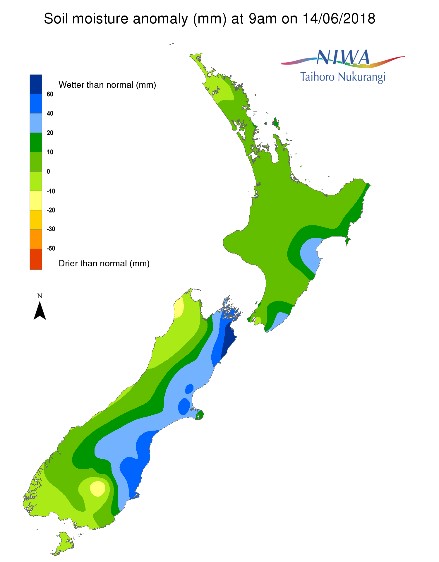

NIWA Soil Moisture Data

NIWA’s latest soil moisture maps (as at 9am Thursday 14 June) continue to show virtually the entire country either around average or wetter than usual at this time of year.

Exchange Rates

|

NZ Dollar versus

|

This Week

(14/6/18)

|

Last Week (7/6/18)

|

Last Month (14/5/18)

|

Last Year (14/6/17)

|

|

US Dollar

|

0.7023

|

0.7039

|

0.6972

|

0.7219

|

|

Australian Dollar

|

0.9282

|

0.9205

|

0.9221

|

0.9577

|

|

Euro

|

0.5953

|

0.5971

|

0.5828

|

0.6437

|

|

UK Pound

|

0.5250

|

0.5242

|

0.5138

|

0.5663

|

|

Japanese Yen

|

77.45

|

77.40

|

76.16

|

79.44

|

|

Chinese Renmimbi

|

4.4917

|

4.4490

|

4.4175

|

4.9072

|

|

Trade Weighted Index

|

73.86

|

73.72

|

72.88

|

77.81

|

Source: Reserve Bank of NZ

Wholesale Interest Rates

|

|

This Week

(14/6/18)

|

Last Week (7/6/18)

|

Last Month (14/5/18)

|

Last Year (14/6/17)

|

|

OCR

|

1.75%

|

1.75%

|

1.75%

|

1.75%

|

|

90 Day Bank Bill

|

1.99%

|

2.00%

|

2.03%

|

1.93%

|

|

10 Year Government Bond

|

3.00%

|

2.87%

|

2.72%

|

2.79%

|

Source: Reserve Bank of NZ