Economic Week - May 11

by Nick Clark

OCR unchanged

The new Reserve Bank Governor, Adrian Orr, has presented his first OCR review. The decision to keep it on hold at 1.75% was universally expected.

Of more interest was the presentation of his statement. The structure and language was conspicuously different from his predecessors even if the conclusion – that expansionary conditions will remain for a considerable period of time – was the same.

Also different was the inclusion of commentary on the state of the labour market. This stems from the Government’s decision to give the Reserve Bank a goal of maximising sustainable employment as well as low and stable inflation. At this stage the two goals are not pulling the Reserve Bank in opposing directions so no problems…yet.

Economists have given Adrian Orr a thumbs up for his fresh and clear messaging.

Budget expectations

Next week will see the first Budget for Finance Minister Grant Robertson. The Government’s finances are in good shape, with a higher than expected surplus for the year to date. It is also continuing to stick with its fiscal responsibility rules despite clamouring from some quarters to breach them, especially the debt target, to enable more spending.

While there has been plenty of talk about the Government’s priorities and a few pre-Budget announcements, like extra funding for MFAT and foreign aid, most of the fireworks were let off in last December’s ‘mini-budget’. The mini-budget implemented a chunk of the new Government’s 100 days programme, and it included big initiatives like its first year of ‘free’ tertiary fees, its families package, and its winter energy payment. It also envisaged around $42 billion of capital spending over five years, mostly in health, education and transport.

As we observed after the mini-budget, there is not a lot of uncommitted spending left for this Budget. The Government is fortunate to have inherited sound finances and that this year’s surplus is running around $900 million more than expected. With the $42 billion capital spending confirmed in a speech this week (and not increased as some were calling for) any extra ‘windfall’ from a higher than expected surplus will likely go towards higher operating spending. One thing we won’t be seeing is any tax cuts!

As well as sticking with the Budget Responsibility Rules, the Minister has also announced that his colleagues have found $700 million of savings and that he expects more savings to be found from within existing allocations. While priorities can be open for debate (like foreign aid versus cheaper doctors’ visits), it’s good that the Government is striving for value for money and we hope this attitude continues.

I will be attending the Budget Lock-up and will be providing a commentary on it. Watch this space.

Ag Census final results

The final results of last year’s Agricultural Production Census were released this week. They largely confirmed the changes in livestock numbers which were provisionally released last December. The final results also included regional breakdowns.

As of 30 June 2017 dairy cattle numbered 6.5 million, up1% on the previous census held in 2012. After growing strongly between 2007 and 2012, since 2012 dairy cattle numbers have oscillated around 6.5 million.

Sheep numbered 27.5 million in 2017, down 12% on 2012. However, the rate of decline appears to have slowed over the past couple of years.

There were 3.6 million beef cattle in 2017, down 3% on 2012. After a succession of declines, beef numbers rose in 2017 compared to 2016.

878,000 tonnes of grains crops were harvested in 2017, down 23% on 2012.

Retail spending falls

Retail card spending fell a seasonally-adjusted 2.2% in April compared to March, according to Statistics NZ’s monthly Electronic Card Transactions statistics. Large falls in grocery & liquor retailing and in fuel retailing contributed to April’s decrease.

This was an unusually large decline in spending, especially considering the price of petrol increased in the month. The decline came after a 1.5% increase in March.

Comparing the months April 2018 and April 2017, retail card spending was up 0.8%.

Banking Survey

Federated Farmers’ six-monthly Banking Survey is open for responses. Federated Farmers members’ received an invitation to participate in the survey so please take a few minutes to let us know about your banking relationships. The survey closes on Monday 14 May and results can be expected later in the month.

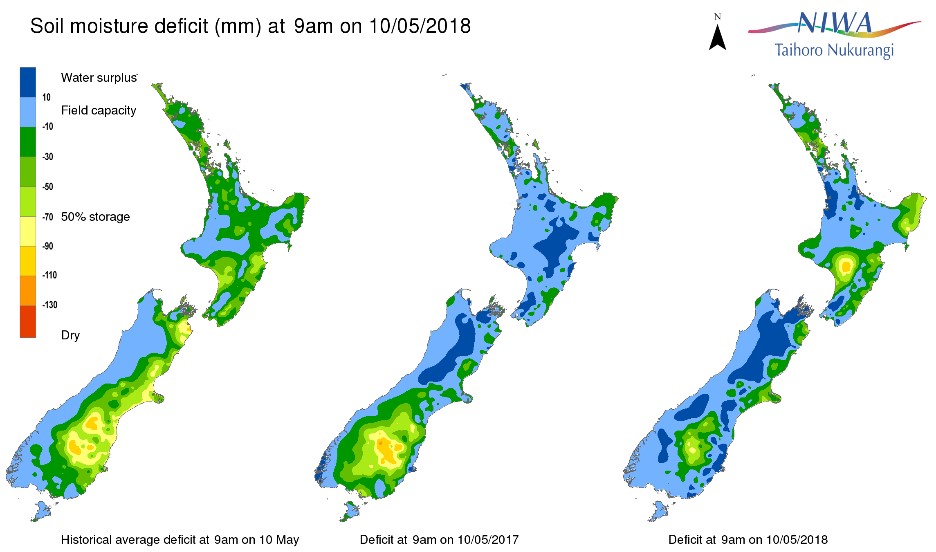

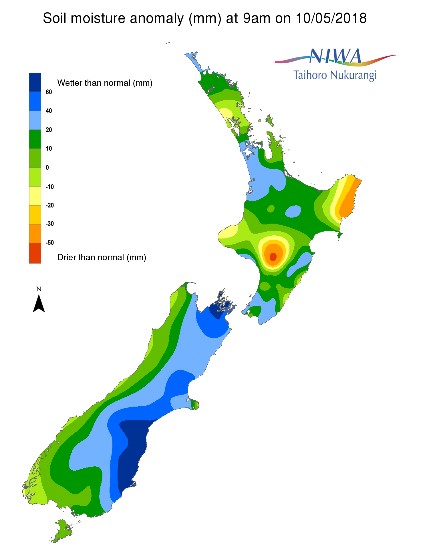

NIWA Soil Moisture Data

NIWA’s latest soil moisture maps (as at 9am Thursday 10 May) continue to show East Cape and Rangitikei as significantly dryer than usual. The east coast of the South Island is still wetter than usual.

Exchange Rates

|

NZ Dollar versus

|

This Week

(10/5/18)

|

Last Week (3/5/18)

|

Last Month (10/4/18)

|

Last Year (10/5/17)

|

|

US Dollar

|

0.6921

|

0.7007

|

0.7317

|

0.6900

|

|

Australian Dollar

|

0.9264

|

0.9323

|

0.9485

|

0.9380

|

|

Euro

|

0.5832

|

0.5851

|

0.5941

|

0.6333

|

|

UK Pound

|

0.5104

|

0.5155

|

0.5179

|

0.5329

|

|

Japanese Yen

|

75.90

|

76.83

|

78.24

|

78.55

|

|

Chinese Renmimbi

|

4.4058

|

4.4607

|

4.6126

|

4.7657

|

|

Trade Weighted Index

|

72.75

|

73.40

|

75.36

|

75.57

|

Source: Reserve Bank of NZ

Wholesale Interest Rates

|

|

This Week

(10/5/18)

|

Last Week (3/5/18)

|

Last Month (10/4/18)

|

Last Year (10/5/17)

|

|

OCR

|

1.75%

|

1.75%

|

1.75%

|

1.75%

|

|

90 Day Bank Bill

|

2.06%

|

2.03%

|

1.99%

|

2.00%

|

|

10 Year Government Bond

|

2.77%

|

2.82%

|

2.78%

|

3.07%

|

Source: Reserve Bank of NZ