Economic Week - May 18

by Nick Clark

The Budget

Budget 2018 was the first Budget for the Labour-NZ First-Green Government. Predictably it was focused on health, education, and housing. There were no surprises.

The Budget had plenty of aspirational language on ‘transformation’ and ending what the Government sees as ‘neglect’ of public services. It wants to ‘turn the page on the ideology of individualism and a hands-off approach to the economy’. This despite economic policies over the past three decades being very successful in turning around New Zealand’s long-term economic decline, dramatically increasing jobs and incomes, and making the economy more resilient to economic shocks.

There will be big increases in spending over the next four years but strong revenue growth means surpluses are forecast to grow and the Government will remain within its Budget Responsibility Rules. Much will depend though on the economy continuing to motor along and continuing drag in more tax revenue.

In terms of the primary industries, there were some crumbs. Overall, the Ministry for Primary Industries will get an additional $38 million in new operating funding over four years. This includes $15 million for the Sustainable Farming Fund, $9 million for strengthening biosecurity, and $5 million for enhancing OVERSEER.

On the other hand, two big-ticket items under the previous government have suffered from significant ‘re-prioritisations’. The Primary Growth Partnership is being cut by $80.6 million over four years and the Crown Irrigation Funding is being cut by $68.1 million over four years. Neither is all that surprising given messages from the Government.

There will also be more funding for combatting predators and biodiversity initiatives, and also the establishment of an ‘RMA oversight unit’ to ‘improve the consistency, effectiveness and transparency of council enforcement of RMA rules and decisions’. This is in response to political concern that some councils haven’t been sufficiently vigorous in their enforcement of the RMA.

The Budget also provided $85 million for the current 2017/18 year for the response to Mycoplasma bovis. However, there were no amounts provided for the coming 2018/19 year let alone for future years. This will depend on decisions that remain to be made, such as on eradication versus long-term management. The Minister of Finance certainly sees it as a risk that could impact on the Government’s finances.

GDT Up

The Global Dairy Trade auction had a welcome rise this week, to finish the 2017/18 season positively.

Overall, prices rose 1.9% compared to previous auction a fortnight ago. Most of the products on offer increased in price, although the biggest product by volume, whole milk powder, was up just 0.2%. Skim milk powder was up 3.0%, anhydrous milk fat up 5.8%, butter up 2.4%, and cheddar up 4.4%.

Overall, the average winning price was US$3,637 and 18,161 tonnes were sold.

The past three months have seen the GDT broadly stable even though it has increased in just two of the last seven auctions. The GDT price index is up 13.9% compared to the end of December 2017 but is down 2.2% on the same time last year.

Fonterra will be making a further update of its 2017/18 milk price before the end of May and an opening forecast for 2018/19. Expectations are that 2017/18’s might be a little higher than the previous forecast of $6.55 per kgMS while 2018/19’s opening forecast might be a little higher again. This will be positive for farmgate returns and should help dairy farmer sentiment, which has been bruised of late.

Profit margins improve for farmers

Statistics NZ’s Business Price Indexes show producer output prices (the prices producers get for their goods and services) rising 0.2% for the March 2018 quarter and 3.5% for the year. Producer input prices (the costs producers pay) rose 0.6% in the March quarter and 4.2% for the year to March. With input prices growing faster than input prices this indicates a contraction in profit margins for businesses as a whole.

It was a different story for farmers though. On an annual basis, dairy cattle farming’s output prices were up 9.2% and input prices were up 3.7%. Sheep, beef cattle and grains farming’s output prices were up 17.1% and input prices were up 5.0%. With output prices growing faster than input prices this indicates an improvement in farm profit margins for the farming groups.

Farm expenses inflation building

The same release showed the farm expenses price index (FEPI) rising 1.2% in the quarter and 3.1% for the year to March 2018. On an annual basis the main upward drivers in the FEPI were:

- Fuel (up 11.2%)

- Electricity (up 6.6%)

- Insurance premiums (up 6.6%)

- Livestock purchases (up 6.0%); and

- Grazing, cultivation, harvest, and purchase of animal feed (up 5.9%).

The FEPI’s annual rate of inflation has crept up over the past couple of years. It was negative for the year to March 2016 (down1.6%), increased into positive territory (up 0.6%) for the year to March 2017, and is now up again to 3.1%, which is getting a little uncomfortable. Thankfully strong growth in output prices have helped ease any discomfort but will this growth continue?

Banking Survey

Thank you to the more than 1,000 farmers who responded to Federated Farmers’ six-monthly Banking Survey. Keep an eye out for results, which can be expected later in the month.

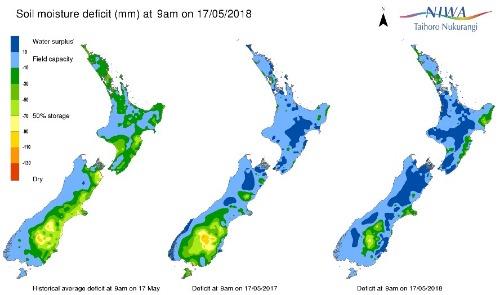

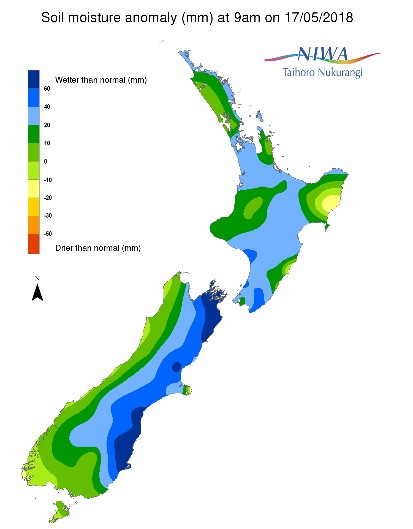

NIWA Soil Moisture Data

NIWA’s latest soil moisture maps (as at 9am Thursday 10 May) continue to show East Cape significantly dryer than usual although Rangitikei has returned to more normal conditions. The east coast of the South Island is still wetter than usual.

Exchange Rates

|

NZ Dollar versus

|

This Week

(17/5/18)

|

Last Week (10/5/18)

|

Last Month (17/4/18)

|

Last Year (17/5/17)

|

|

US Dollar

|

0.6913

|

0.6921

|

0.7355

|

0.6885

|

|

Australian Dollar

|

0.9183

|

0.9264

|

0.9462

|

0.9289

|

|

Euro

|

0.5852

|

0.5832

|

0.5941

|

0.6204

|

|

UK Pound

|

0.5102

|

0.5104

|

0.5130

|

0.5329

|

|

Japanese Yen

|

76.25

|

75.90

|

78.71

|

77.56

|

|

Chinese Renmimbi

|

4.3972

|

4.4058

|

4.6175

|

4.7393

|

|

Trade Weighted Index

|

72.61

|

72.75

|

75.50

|

74.90

|

Source: Reserve Bank of NZ

Wholesale Interest Rates

|

|

This Week

(17/5/18)

|

Last Week (10/5/18)

|

Last Month (17/4/18)

|

Last Year (17/5/17)

|

|

OCR

|

1.75%

|

1.75%

|

1.75%

|

1.75%

|

|

90 Day Bank Bill

|

2.00%

|

2.06%

|

1.95%

|

1.98%

|

|

10 Year Government Bond

|

2.83%

|

2.77%

|

2.84%

|

2.91%

|

Source: Reserve Bank of NZ