Economic Week - November 30

by Nick Clark

Financial stability improves

Risks to financial stability have eased, according to the Reserve Bank’s six-monthly Financial Stability Report.

The main news from the report was the Reserve Bank relaxing loan-to-value restrictions on residential mortgage lending. However, as with previous reports this one also devoted commentary to dairy sector debt which it continues to consider a risk to the financial system.

In summary the report observed that “indebtedness remains high in the agriculture sector, particularly for dairy farms. While the sector is currently profitable, commodity prices are volatile and the sector remains vulnerable to another downturn. In addition, there are a number of longer-term challenges facing the sector, including managing the risks of climate change. It remains important for the sector as a whole to continue to repair its balance sheets, to restore resilience to a future downturn and to allow farms to invest to adapt to medium-term challenges.”

As well as climate change other medium-term challenges include Mycoplasma bovis and tighter regulation of freshwater management. The Reserve Bank considers the sector’s debt levels limit its capacity to withstand market downturns and invest to adapt over the longer term. So, it is keen for dairy farmers to pay down debt.

For a further take on farm debt, the results of Federated Farmers’ November Banking Survey should be out next week. Watch this space.

Record lambing percentage

The average ewe lambing percentage for 2018 was 129.0%, up 1.7 points on 2017’s 127.3%, and setting a new record high.

In its annual Lamb Crop Report, Beef+Lamb NZ’s Economic Service estimates the number of lambs tailed in spring 2018 was 23.5 million head, down 0.7% (163,000 head) on the previous spring, with the small decline being due to the higher lambing percentage not offsetting a 2.1% decline in breeding ewes.

In the North Island, the lamb crop was down 3.2% to 11.3 million but in the South Island there was a 1.7% increase to 12.2 million. The lambing percentage was also higher in the South Island (129.9%) than the North Island (128.1%).

Beef+Lamb NZ is also forecasting a reduction this season in lambs to be processed for export (down 4.1%) and adult sheep to be processed for export (down 14.4%).

Confidence stalled

Business confidence didn’t worsen in November but nor did it improve, according to ANZ’s monthly Business Outlook Survey.

Overall, a net 37.1% of businesses expect general economic conditions to worsen over the coming year, unchanged from October, while a net 7.6% expect their own activity to increase (up 0.2 points).

The picture was slightly better for agricultural respondents. Although a still dismal net 55.9% expect general economic conditions to worsen, this is a 6.9-point improvement on October. Meanwhile a net 5.7% expect their own activity to increase, an 8.0-point improvement on October’s negative result.

Imports boom

Monthly imports broke through $6 billion for the first time as New Zealand recorded another big trade deficit.

Statistics NZ’s monthly Merchandise Trade Statistics showed that October’s goods exports of $4.9 billion were well and truly outweighed by $6.2 billion of goods imports. This resulted in a goods trade deficit of $1.3 billion.

Exports were up $303 million (or 6.6%) on October 2017. Fruit led the way, up $118 million (or 137%), mainly due to kiwifruit. Meat exports were up 19.8% to $450 million and wool was up 35.6% to $79 million, but dairy exports were down 3.3% to $1.2 billion.

Imports were up 14.1% for the month, mainly due to a low NZ Dollar and higher international oil prices. Petroleum imports were up 68.2% to $633 million.

For the year to October 2018 the goods trade deficit ballooned out to $5.8 billion, the biggest since 2007. Exports were up 10.5% to $57.2 billion but imports grew more strongly, by 15.1% to $63.0 billion.

Retail sales flat

Statistics NZ’s quarterly Retail Trade Survey showed that comparing the September 2018 quarter with the June 2018 quarter the total value of retail sales was up 0.6%.

Fuel retailing was by far the biggest contributor, up 7.0% for the quarter, thanks to sharply higher petrol and diesel prices during the quarter. Excluding fuel, retail sales were essentially flat.

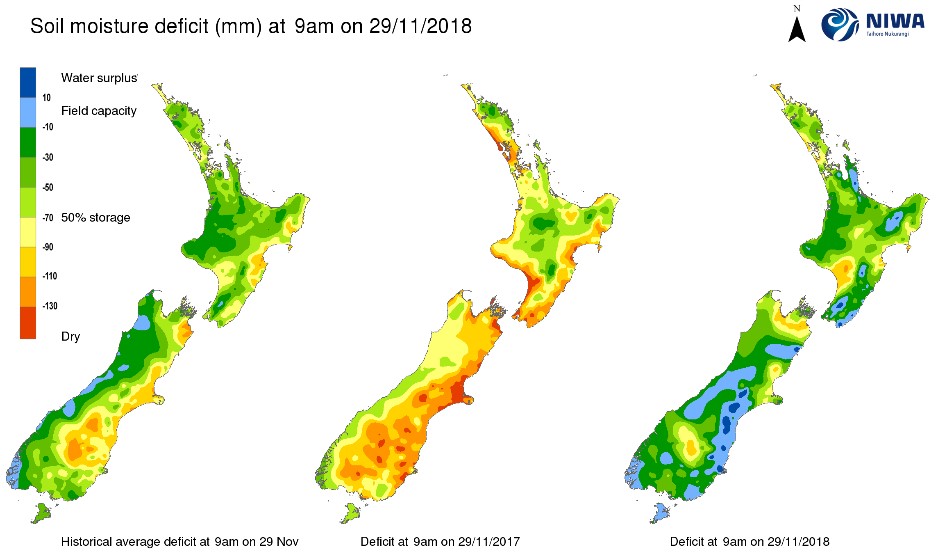

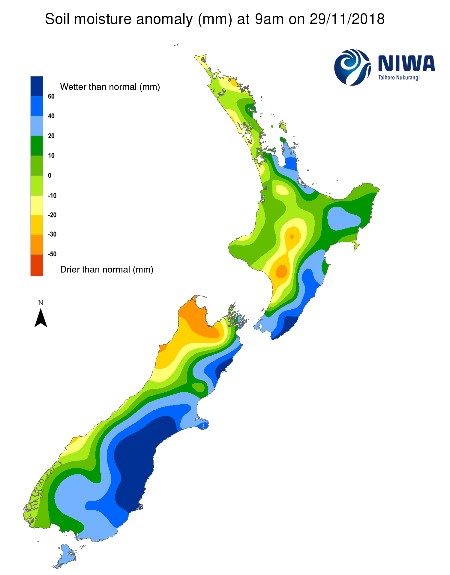

NIWA Soil Moisture Data

NIWA’s latest soil moisture maps (as at 9am Thursday 29 November) show the effect of rain over the past week. The east coast of the South Island remains a lot wetter than usual but some areas in the North Island that were significantly dryer than usual last week are now significantly wetter than usual.

Exchange Rates

Over the course of the week the NZ Dollar up slightly against the Trade Weighted Index and was only slightly changed (up and down) against our main trading partners.

|

NZ Dollar versus

|

This Week

(29/11/18)

|

Last Week (22/11/18)

|

Last Month (29/10/18)

|

Last Year (29/11/17)

|

|

US Dollar

|

0.6843

|

0.6829

|

0.6523

|

0.6888

|

|

Australian Dollar

|

0.9376

|

0.9404

|

0.9205

|

0.9064

|

|

Euro

|

0.6020

|

0.5997

|

0.5727

|

0.5814

|

|

UK Pound

|

0.5336

|

0.5344

|

0.5085

|

0.5155

|

|

Japanese Yen

|

77.71

|

77.23

|

73.02

|

76.88

|

|

Chinese Renmimbi

|

4.7601

|

4.7385

|

4.5321

|

4.5422

|

|

Trade Weighted Index

|

74.84

|

74.73

|

71.84

|

72.79

|

Source: Reserve Bank of NZ

Wholesale Interest Rates

The 90-day Bank Bill rate was down slightly (2 basis points) for the week while the 10-year Government Bond both retreated 9 basis points. The OCR has been unchanged on 1.75% since November 2016.

|

|

This Week

(29/11/18)

|

Last Week (22/11/18)

|

Last Month (29/10/18)

|

Last Year (29/11/17)

|

|

OCR

|

1.75%

|

1.75%

|

1.75%

|

1.75%

|

|

90 Day Bank Bill

|

1.98%

|

2.00%

|

1.89%

|

1.92%

|

|

10 Year Government Bond

|

2.62%

|

2.71%

|

2.52%

|

2.77%

|

Source: Reserve Bank of NZ