Economic Week - November 9

by Nick Clark

OCR unchanged

On Thursday the Reserve Bank kept its Official Cash Rate on hold at 1.75%. No surprise there.

Of more interest though was the Bank’s accompanying statement. In it, Governor Adrian Orr took a somewhat less ‘dovish’ position than previously, noting that there are both upside risks and downside risks and dropping references to a possible OCR cut. Instead it seems more likely that the OCR will stay on hold through 2019 and into 2020 before rising.

The Reserve Bank’s forecasts were finalised well before key labour market statistics were released on Wednesday. The Reserve Bank would have been as surprised as anyone with the strong results, including the big drop in unemployment (more on this further below).

At 3.9% the unemployment rate is now well below most estimates of a non-inflationary rate of unemployment, meaning we are probably above ‘maximum sustainable employment’. However, the vagueness of the Reserve Bank’s new employment target, in contrast to the well-established and non-contentious inflation target, potentially opens this up for vigorous debate.

The markets interpreted the Reserve Bank’s statement as being more ‘hawkish’ and wholesale interest rates and the NZ Dollar both strengthened in response.

Commodity prices down again

ANZ’s Commodity Price Index has recorded yet another fall in commodity prices. Overall, prices slipped 2.4% in the month of October, the fifth consecutive monthly fall and dragging the Index down 5.6% compared to October 2017.

Dairy prices fell 3.1% during the month to be down 12.3% annually. Meat and fibre prices fell 2.0% for the month and were down 4.3% annually. Higher lamb prices were more than offset by lower beef prices.

Weaker world prices were partially offset by a slightly softer NZ Dollar, with the NZD Index falling 1.6% for the month. Annual growth in the NZD Index is slowing but remains positive (for now), coming in at 1.6%. The NZ Dollar has strengthened markedly over the past couple of weeks which will likely dampen world prices when expressed in NZ Dollars.

GDT down again

Dairy prices continued their extended slide at this week’s Global Dairy Trade auction. The GDT Price Index was down 2.0% from the last auction held mid-October.

Prices were down across the range of commodities with only two posting a gain, butter milk powder (up 0.8%) and skim milk powder (up 1.2%). Whole milk powder, the biggest by volume, was down 2.9%, cheddar was down 4.6%, butter was down 1.7% and anhydrous milk fat was down 1.3%.

The average selling price was US$2,851 and 42,212 tonnes were sold.

The GDT has now fallen at ten of the last eleven auctions and is down 12.6% compared to the same time last year.

Unemployment down

Statistics NZ’s Labour Market Statistics for the September 2018 quarter showed unemployment falling by 13,000 in the quarter to a rate of 3.9%. Not only was this down from 4.4% in the June quarter but it is the lowest unemployment rate since June 2008.

Meanwhile, the employment rate climbed to 68.3%, its highest since the measure was created thirty years ago. Employment as measured by the Household Labour Force Survey grew by 29,000 in the quarter (up 1.1%) and by 73,000 for the year (up 2.8%). There was some noise in the overall data, with the Quarterly Employment Survey’s job growth slower, up 0.3% and up 1.2% respectively.

Meanwhile, wage growth was modest, with the Labour Cost Index’s private sector hourly rate increasing 0.5% in the quarter and 1.9% for the year. Excluding the impact of April’s boost to the minimum wage, it is estimated that underlying wage inflation is around 1.7%.

Bank culture and conduct

Banks have been in the spotlight with the report of the joint Reserve Bank/Financial Markets Authority Review of Bank Conduct and Culture out this week. The review found weaknesses in governance and management of conduct risks and the Government has warned the banks to lift their game or face regulation.

Federated Farmers’ six-monthly Banking Survey has been in the field this week. We expect to release the results in early December.

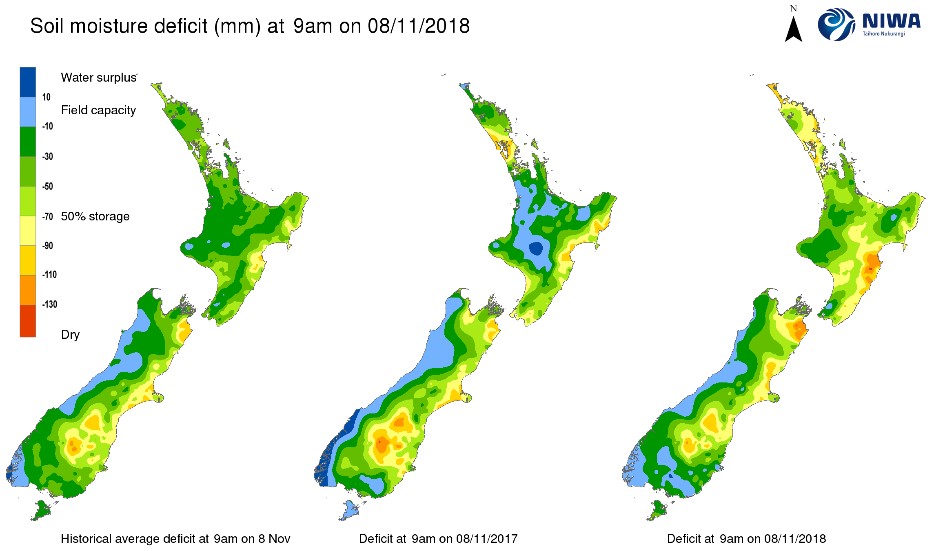

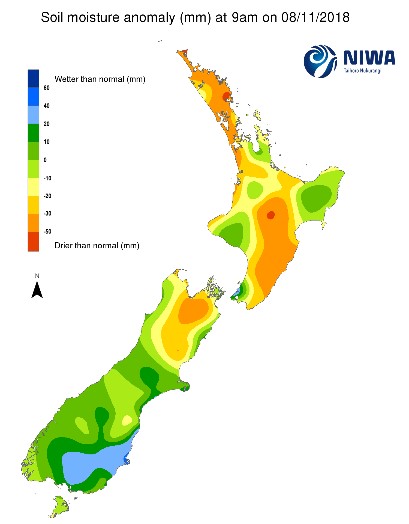

NIWA Soil Moisture Data

NIWA’s latest soil moisture maps (as at 9am Thursday 8 November) show it being particularly dryer than usual in the Northland, Rodney, Taupo, Central Hawkes Bay, Tararua, and Nelson areas. Coastal Otago and Southland are wetter than usual.

Exchange Rates

Overall, the NZ Dollar was up over the week against the Trade Weighted Index and it was stronger against all the major currencies we trade with. It has appreciated quite strongly over the past month against all the major currencies and overall it is above where it was this time last year.

|

NZ Dollar versus

|

This Week

(8/11/18)

|

Last Week (1/11/18)

|

Last Month (8/10/18)

|

Last Year (8/11/17)

|

|

US Dollar

|

0.6778

|

0.6540

|

0.6427

|

0.6905

|

|

Australian Dollar

|

0.9320

|

0.9205

|

0.9116

|

0.9024

|

|

Euro

|

0.5928

|

0.5773

|

0.5579

|

0.5956

|

|

UK Pound

|

0.5163

|

0.5092

|

0.4899

|

0.5243

|

|

Japanese Yen

|

77.00

|

73.76

|

73.17

|

78.56

|

|

Chinese Renmimbi

|

4.6943

|

4.5608

|

4.4222

|

4.5792

|

|

Trade Weighted Index

|

74.01

|

72.14

|

70.60

|

73.49

|

Source: Reserve Bank of NZ

Wholesale Interest Rates

The 90-day Bank Bill rate was up 6 basis points over the week while the 10-year Government Bond was up 22 basis points. The OCR has been unchanged on 1.75% since November 2016

|

|

This Week

(8/11/18)

|

Last Week (1/11/18)

|

Last Month (8/10/18)

|

Last Year (8/11/17)

|

|

OCR

|

1.75%

|

1.75%

|

1.75%

|

1.75%

|

|

90 Day Bank Bill

|

1.98%

|

1.92%

|

1.88%

|

1.94%

|

|

10 Year Government Bond

|

2.76%

|

2.54%

|

2.63%

|

2.82%

|

Source: Reserve Bank of NZ