Economic Update - October 19

by Nick Clark

Inflation rises

Inflation increased to 1.9% in the September 2018 year, according to Statistics NZ’s quarterly

Consumer Price Index. This is an acceleration from the June 2018 year’s annual rate of 1.5%.

The quarterly increase of 0.9% was ahead of market expectations and was influenced by higher costs for transport (up 2.4%) and housing and household utilities (up 1.1%). Transport was of course driven by petrol prices, which were up 5.5% for the quarter (and 19.0% for the year).

Annual inflation of 1.9% is now almost at the Reserve Bank’s 1-3% target mid-point of 2%. It it is likely to push over 2% in the December quarter, after a negative figure for the December 2017 quarter falls out.

Although inflation is building, the Reserve Bank is likely to look through the short-term impact of recent petrol price increases and emphasise the temporary boost they will give to the CPI. Indeed, when excluding petrol, quarterly inflation would have been 0.6% and annual inflation 1.2%. The risk to the Reserve Bank’s stance will rise if higher petrol prices spill over into more generalised inflationary pressures. This will be more and more likely if petrol prices stay high or if they continue to push even further upwards.

Another perennial inflationary driver is local government rates and payments. These were up 5.1% for the September 2018 year, well above the 4.2% average increase over the past five years. Rates increases that are persistently and significantly higher than the CPI is something the Productivity Commission will need to get to the bottom of when it begins its long anticipated Inquiry into Local Government Funding.

Rosy export outlook

MPI’s latest forecast suggests New Zealand's primary industry exports will increase this season, a welcome consolidation on last season’s ‘exceptional’ result.

The September update to the

Situation and Outlook for Primary Industries, released this week, forecasts primary industry exports to be $43.8 billion in 2018/19, up 2.5% on 2017/18’s $42.7 billion. 2017/18 had been a very good year (up 11.8% on 2016/17’s $38.2 billion) so to increase further would be a very good outcome.

Horticulture is expected to be the big mover, with its exports forecast to jump 13.1% to $6.1 billion, thanks to a 22.6% increase for Kiwifruit and solid gains across other fruits and vegetables. Dairy exports are forecast to increase 2.1% to $17.0 billion, with flat production and lower global commodity prices more than offset by a changing product mix towards higher value products. However, after a strong 2017/18 meat and wool exports are forecast to fall 1.3%, with continued high prices not able to offset the effect of reduced production of lamb, mutton and beef.

These forecasts are always at the mercy of factors like the weather, global commodity prices and the exchange rate but they paint a generally positive picture. Let’s hope it pans out.

GDT down again

The

Global Dairy Trade auction posted yet another loss this week, down 0.3% compared to the last auction a fortnight ago.

Three commodities posted gains, anhydrous milk fat (up 1.0%), butter (up 2.4%) and lactose (up 1.5%). However, these price rises were more than offset by falls for whole milk powder (down 0.9%, cheddar (down 1.8%) and rennet casein (down 1.7%). Skim milk powder was unchanged.

The GDT has now fallen in nine out of ten auctions since late May. The one exception was a no-change result. The last time the GDT increased was on 15 May.

Since 15 May’s increase the GDT price index has fallen by 15.9% and it is also down 13.8% compared to the same time last year. Thanks to the lower exchange rate against the US Dollar, the GDT’s losses are smaller when converted into NZ Dollars but they are still losses.

Competitiveness slipping

New Zealand has dropped two places from 16th to 18th in this year’s

Global Competitiveness Index.

The Index is a ranking of economic competitiveness, based on economic data and surveys of large businesses in 140 countries.

The good news was New Zealand coming in first place for macroeconomic stability, strength of institutions, lack of corruption, and time to start a business. We also ranked highly for social capital, efficiency of legal framework, intellectual property protection, and soundness of banks.

The bad news was relatively poor rankings for adequacy of infrastructure, burden of regulation, quality of research institutions, capital availability, and market capitalisation.

NIWA Soil Moisture Data

NIWA’s latest

soil moisture maps (as at 9am Thursday 18 October) show the country continuing to dry out, with dryer-than-usual conditions prevailing across most of the North island and parts of the upper South Island. The Auckland, Taupo, Manawatu and coastal Wairarapa/Tararua and Hurunui areas are particular dryer than usual. Coastal Otago remains wetter than usual though.

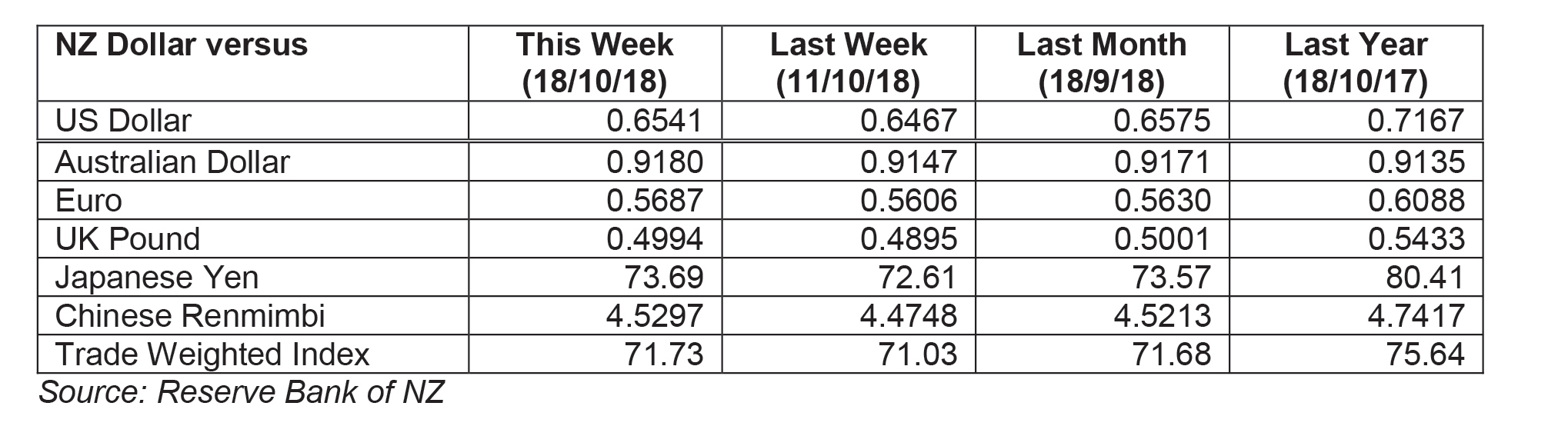

Exchange Rates

The NZ Dollar was up against the Trade Weighted Index and up against the currencies of all of our major trading partners.

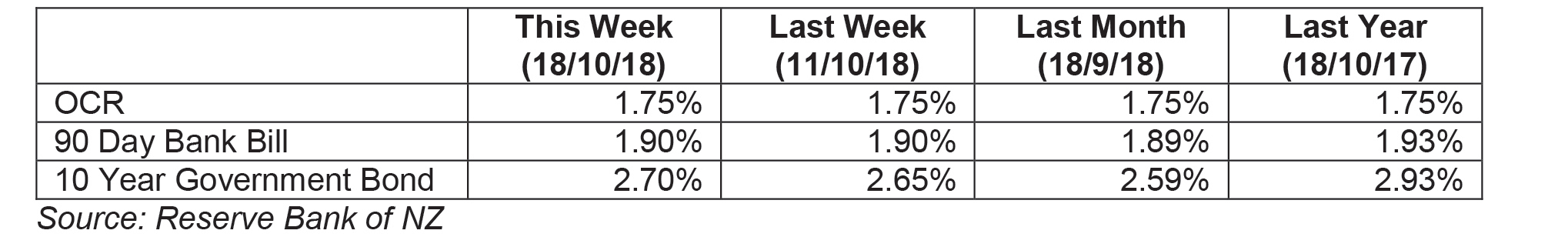

Wholesale Interest Rates

The 90-day Bank Bill rate was stable over the week although the 10-year Government Bond rate was up slightly. The OCR has been unchanged on 1.75% since November 2016.