Economic Update - October 5

by Nick Clark

It was a week of ‘agains’ with economic data continuing their recent trends…sadly none of them in the right direction…

GDT falls – again

The

Global Dairy Trade auction continued its run of losses, falling 1.9% at this week’s event, on the back of strong New Zealand milk production.

Five of eight commodities dropped in price, including the biggies by volume – whole milk powder (down 1.2%), skim milk powder (down 0.3%), cheddar (down 1.2%), anhydrous milk fat (down 4.4%), and butter (down 5.9%). The three that rose were relatively lower volume commodities.

Overall the winning price was $US2,901 and 41,981 tonnes were sold.

The GDT Price Index has fallen in eight of its last nine auctions and has not had an increase during the current season, which started at the end of May. It is down 14.5% on this time last year.

Economists have been cutting their forecasts for this season’s milk price. Some are suggesting it will be around $6.30 per kg MS, well below Fonterra’s current forecast of $6.75.

Commodity prices down – again

The

ANZ World Commodity Price Index fell for a fourth consecutive month, down 1.8% in September to push annual growth further into negative territory (down 3.0% for the year).

Dairy prices fell 3.0% during the month and meat and fibre prices fell 0.4%, with beef down 1.5% and lamb down 0.4%. Despite slipping slightly in September, lamb prices remained 7.4% higher than the same time last year. However, beef prices were down 9.2% for the year and dairy prices were down 11.1%.

The slightly better news was that lower world prices were partially offset by a further 0.7% fall in the exchange rate. The NZ Dollar index fell by a more modest 0.6% for the month and annual growth eased back to a still positive 6.5%.

Business confidence disappoints - again

Once again business confidence has made the headlines, with NZIER’s closely watched

Quarterly Survey of Business Opinion falling in the September quarter.

A net 28% of businesses expect economic conditions to worsen – down 7 points on June’s result to its lowest level since March 2009 when we were in the midst of the Global Financial Crisis.

Firms’ own domestic trading activity is a better indicator of GDP growth than business confidence. However, this was also bad news with firms’ own activity for the September quarter down as well as expectations for the next quarter. A net 0.4% of firms reported higher demand over the September quarter – also down 7 points on June to the lowest level since September 2012.

NZIER found that government policy, labour costs, consumer confidence, availability of labour and operating margins were the key concerns for businesses. It was noted though that most of the survey was completed prior to the release of the surprisingly strong June quarter GDP result.

The QSBO is the survey that gets the most attention from the economics fraternity and from policy makers. It does not survey farmers but it does survey businesses that service the agricultural sector.

Ag debt edges up - again

Agricultural sector was worth $62.2 billion in August 2018, according to the Reserve Bank’s monthly

Sector Lending Statistics. This was up $101 million on July 2018 and $1.7 billion (or 2.8%) on August 2017.

Annual growth in agricultural debt of 2.8% remains well below those for the housing (6.1%), personal consumer (5.6%) and business (5.5%) sectors.

NIWA Soil Moisture Data

NIWA’s latest soil

moisture maps (as at 9am Wednesday 3 October) continue to show coastal Otago wetter than usual while the Hurunui area is dryer than usual. Other parts are also getting a bit dryer including North Waikato, Bay of Plenty, coastal Wairarapa and Nelson.

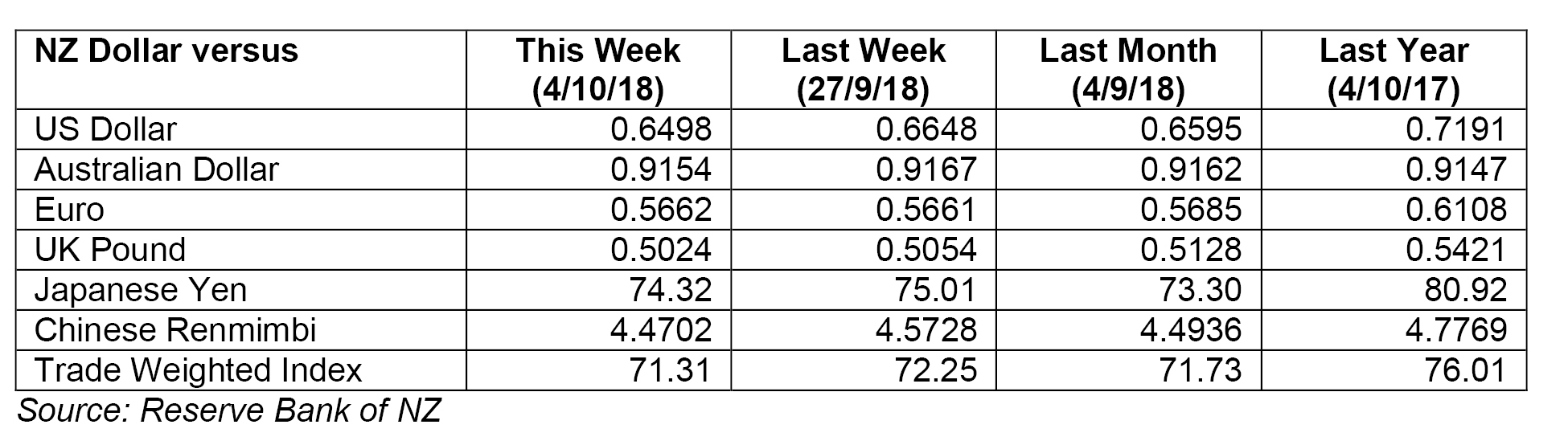

Exchange Rates

The NZ Dollar was down against the Trade Weighted Index and down against most of our main trading partners’ currencies, with the exception of the Euro where it was unchanged.

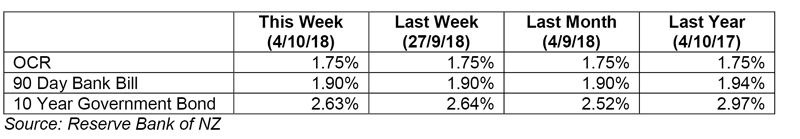

Wholesale Interest Rates

Wholesale interest rates (90 day and 10 year) were stable over the week. The OCR has been unchanged on 1.75% since November 2016.