Economic Week - September 21

by Nick Clark

GDP surprises

The economy grew faster than expected in the June 2018 quarter, with Statistics NZ’s

Gross Domestic Product showing growth of 1.0% in the quarter. Most economists were expecting quarterly growth of between 0.5% and 0.9%.

Agriculture, forestry and fishing was the industry with the strongest quarterly growth, up 4.1%. This was thanks mainly to weather-related recovery in milk production and, not so happily, Mycoplasma bovis-related livestock slaughter.

Growth though was broad-based, with 15 of 16 industries recording higher production. Mining was the only industry to decline.

For the year ended June 2018 GDP grew by 2.7% compared to the year ended June 2017. Agriculture, forestry and fishing was up a more modest 0.7% for the year, a legacy of what was a mixed season for production.

External deficit widens

New Zealand’s current account deficit for the year ended June 2018 widened to $9.5 billion, according to Statistics NZ’s

Balance of Payments and International Investment Position.

The deficit was $2.4 billion larger than for the year ended June 2017 and it also increased as a percentage of GDP, from 2.6% to 3.3%. The main driver of the increase was a larger goods trade deficit, with imports rising much more rapidly than exports. In contrast the services balance was in surplus, thanks to strong tourist inflows.

Economists expect the current account deficit to increase further, especially if export prices ease back relative to import prices. Recent falls in the GDT suggest this is happening, at least for dairy exports.

While an increase in the current account deficit to above 4% would take it higher than what we’ve been used to lately, it has been much higher in the past and it in fact peaked at an eye-watering 7.8% in 2009.

Meanwhile, as at 30 June 2018 New Zealand’s net liability position was $158 billion, or 54.6% of GDP. The net liability position has narrowed significantly since it peaked at 84.2% of GDP in March 2009. An increasing current account deficit could see it start to widen again though.

GDT down again

The

Global Dairy Trade auction lost further ground in this week’s auction, slipping 1.3% overall.

Almost all of the commodities on offer fell in price, with whole milk powder down 1.8% and skim milk powder down 1.1%. The sole exception was rennet casein, up 1.7%. The average selling price was $US2,934 and 39,143 tonnes were sold.

The GDT Price Index has fallen at seven of the past eight auctions. It is down 14.0% over the past four months and down 14.8% compared to the same time last year.

The Future of Tax

This week the Tax Working Group (TWG) released its

interim report. The 194-page report provides a very thorough examination of the tax system and a direction of travel for the remainder of its work through to its final report in February.

Capital gains tax has been a big part of the TWG’s focus and most of the pre-release commentary has centred on it. Extending the taxation of capital income will, in the TWG’s view, improve the fairness and equity of the tax system and provide a more level playing field between different types of investment. However, it will also make the tax system more complicated and will increase administration and compliance costs. It will also increase the potential tax burden for farmers, as owners of significant assets.

The interim report floats two options. The first option is extending the existing tax net through the taxation of assets when sold which are not already taxed. The second option is taxation of deemed returns on certain assets using a risk free rate of return. Taxation of deemed returns would be fraught with difficulty and could mean hefty annual tax bills even if a business is making a loss.

Although neither form of taxation of capital income will be appealing, the first option would certainly be better, especially if it includes ‘roll-over relief’ for intergenerational farm sales and for when farmers ‘trade up’ to a bigger farm. These were issues we raised in our submission to the TWG as potential impediments to respectively farm succession and business growth. It’s good to see them acknowledged.

Much of the rest of the TWG’s time will now be spent on refining its capital gains tax proposal.

Environmental taxation is another thorny issue. The TWG seems keen on the potential for environmental taxes for greenhouse gases, water pollution, water abstraction, solid waste and road transport. However, rather than recommending specific new taxes the interim report proposes a frameworks approach for determining whether taxes should be used as opposed to other measures such as regulation.

Encouragingly, the TWG supports QEII covenant expenses being treated as deductible to reward care of the land but on the other hand some existing agricultural tax concessions might be on their way out if considered bad for the environment. The TWG will be looking further into these issues.

The best news though is that the TWG is not recommending a land tax (a universally unpopular measure among farmers) or any changes to New Zealand’s world class GST. It is also (sensibly) not looking to change company taxation.

Once the TWG delivers its final report the Government will consider it and will legislate for any changes. While legislation may be passed prior to the 2020 General Election, the Government has promised that any changes won’t take effect until after that election.

Federated Farmers will continue to engage with the TWG as it works towards its final report. Our focus will be on capital gains tax and environmental taxation.

Next week…

Next week’s main economic event will be the Reserve Bank’s OCR review. There’s no virtually debate that it will remain on hold at 1.75%. Of interest will be whether the June quarter’s surprisingly strong GDP result influences the Reserve Bank’s outlook for inflation and employment and when and in what direction the OCR will next be adjusted.

NIWA Soil Moisture Data

NIWA’s latest

soil moisture maps (as at 9am Thursday 20 September) show the country drying out relative to usual conditions for this time of the year, including Waikato, North Taranaki and Manawatu. Coastal areas of Gisborne, Marlborough and East Otago are damper than usual though.

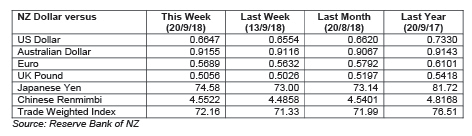

Exchange Rates

The surprisingly strong GDP result pushed the NZ Dollar up for the week against the Trade Weighted Index basket of currencies and against all of the main currencies we trade.

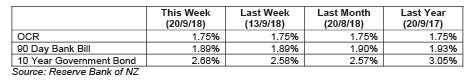

Wholesale Interest Rates

The 90-day bank bill rate was steady this week but the 10-year government bond rate edged up. The OCR has been steady on 1.75% since November 2016. It will almost certainly be the same after next week’s OCR review.