2016 Rates Report

Newsletter - December 2016

Federated Farmers advocates for rural communities locally and nationally on the problem of local authority rates. Governance, members and staff annually submit to most local authorities on their rating policies and financial plans, and put many hours into engagement with councils and campaigns to get equity into local rating policies. The Federation also works hard to bring government’s attention to the enormous cost of rates to farm businesses. Our goal is to bring an end to local government’s dependence on the rating of land and capital value, and see it replaced with an equitable and efficient taxation system.

Looking out for you

by Katie Milne

Local Government Spokesperson Federated Farmers of New Zealand

Federated Farmers is well known for strong and informed advocacy on local government issues. Much of our attention these days focusses on the challenges of environmental regulation, but the cost of rates to farmers is not forgotten and thoroughly taken on at local and national level.

This newsletter offers up the highlights of our 2016 work on getting farm rates down, with reports from the coal face on annual plan submissions and decisions along with commentary on the current events in local government.

The cost of rates continues to be a big issue for farm businesses; we remain stuck with the problem of modern local government – with all its many challenges – confined to a tax based on property value. Federated Farmers is the only lobby out there trying to contain farm rates locally, through engagement with councils on their rating policies, and at national level through advancement of the case for better ways to tax for local services.

This vigilance has much value for farmers as an exercise in containment on rates levels and sometimes rollback - but as anyone taking on city hall knows local rates are fraught with peril. This year we dealt with new consultation processes for annual plans often light on detail, yet there were still surprises such as rates spikes for farms in districts with new valuations that took in the tail end of the dairy boom.

This vigilance has much value for farmers as an exercise in containment on rates levels and sometimes rollback - but as anyone taking on city hall knows local rates are fraught with peril. This year we dealt with new consultation processes for annual plans often light on detail, yet there were still surprises such as rates spikes for farms in districts with new valuations that took in the tail end of the dairy boom.

An income drop spiced with a rates rocket turned out to be the recipe for affected farmers, and you’ll see in these pages our efforts on their behalf.

On the big picture there were meagre offerings as central government showed little sign of taking up the funding reform challenge, most recently from Local Government New Zealand who have been pushing for modernisation through their Funding Review – an initiative with backing from a number of organisations including the Feds.

Amalgamation is a big issue that’s gone off the boil, and we discuss government’s latest attempt to reorganise things in these pages.

Read on, and do not despair: Federated Farmers is looking out for you.

STATE OF THE GAP

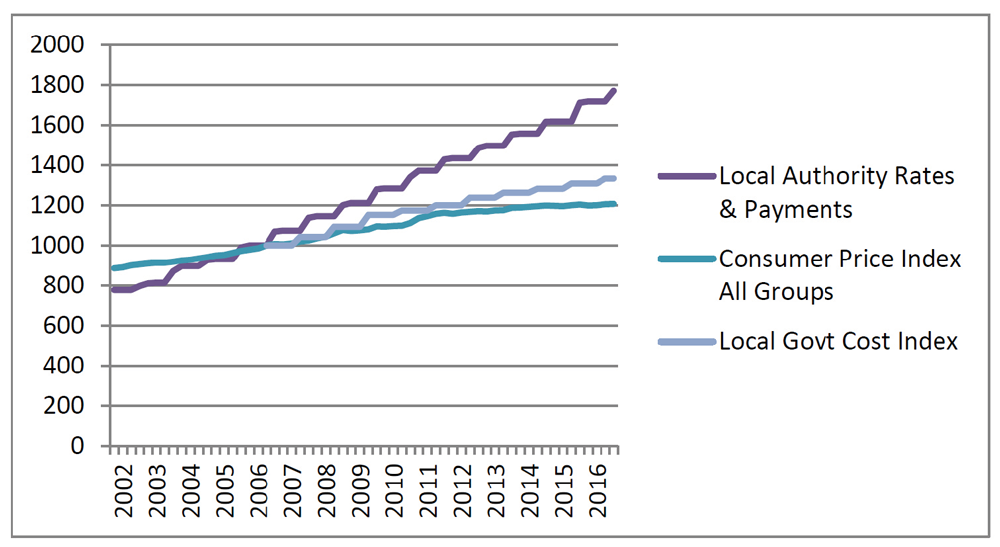

Our annual comparison of the growth in rates compared to other costs.

The graph below shows the ever growing gap between rates increases (as measured by the Local Authority Rates & Payments sub-index to the Consumer Price Index) and inflation in the wider economy (as measured by the Consumer Price Index: All Groups).

This year we have added another line - the Local Government Cost Index (LGCI). The LGCI measures price increases in areas more specific to the local government sector, like roads and infrastructure. The LGCI was developed and has been maintained by BERL on behalf of the Society of Local Government Managers.

Rates versus CPI and LGCI: 2006-2016 (2006=1000)

Over the past 10 years the LGCI increased by 33 percent, a bit faster than the overall CPI’s 21 percent. However, this is dwarfed by the 77 percent increase for rates.

Big Question: Why have rates increased so much faster than local government’s own price measures? Given that the LGCI looks at prices but does not factor increased activity into the impact on rates the growing scope of local government would seem to be in play here. An avalanche of new demands for regulation, the challenges of population growth and decline, and the promotion of ‘major events’ and of tourism with its impact on infrastructure, are all impacting on the height of the rates bar.

Owners of land intensive businesses, such as farms, will be surely be paying a big share of that ten-year, 77 per cent increase, regardless of income – sure confirmation that local taxes need to be re-designed to reduce reliance on property value rates.

Rating revaluations

The rates you pay come mainly down to property value. The timing of revaluations has a big influence too

Rating revaluations are done every three years and values can change dramatically, along with the proportion of rates revenue paid by different property types. This year Federated Farmers encountered a number of cases where revaluations undertaken in 2015 significantly lifted farming sector capital values relative to residential and commercial/industrial.

For example, Kaikoura District’s 2015 revaluation saw the capital value of its farming properties rise by 15 percent compared to residential properties increasing by 3 percent and commercial and industrial properties both declining by around 9 percent.

The upshot of this were proposed rates increases of less than $50 per year (or less than 3 percent) for typical residential properties while one farm was looking at an increase of $1,475 (or close to 13 percent).

In Kaikoura we were able to ease some of this impact through getting a rural differential on the general rate. In other areas we weren’t so fortunate with some councils barely consulting or not consulting at all despite revaluations having material impacts on farm rates.

Some might say the opposite could happen next year if lower dairy farm prices are considered alongside booming housing markets. This is possible but the lottery of when a revaluation happens is not a fair way to work out how much we’ll pay for the next three years, especially for services that have little connection to the relative value of the property.

Councils can actually do quite a bit to address this inequity. They can use rates remission policies to smooth out particularly unjust increases caused by revaluations, they can make greater use of differentials, or they can use more uniform annual charges or, where appropriate, more user pays.

It is important we keep on top of areas where revaluations are happening this year so we can be ready for next year’s rates setting through annual plans.

The districts that have done revaluations this year are: Buller, Central Otago, Christchurch, Dunedin, Far North, Gore, Hastings, Horowhenua, Hurunui, Hutt, Manawatu, New Plymouth, Opotiki, Otorohanga, Porirua, Upper Hutt, Waimakariri, Waimate, Waipa, Whakatane, and Whanganui. Watch out for them.

So let us know if your farm’s rateable value is being hiked substantially following your council’s 2016 district wide revaluation.

Wealth transfer or wise investment?

Paying rates to council to fund promotion of the tourism industry has annoyed many farmers for many years. In Ruapehu the Federated Farmers executive made the case that a fairer rating system would do just as much for the local economy

Economic growth and development is given a big emphasis by local government, particularly since the global financial crisis of 2008 and its highlighting of regional weaknesses. Growth strategies are seen by many councils as one path to jobs and a strengthening of regions affected by ageing population, declining infrastructure and fewer businesses.

Much of local government’s focus has been on tourism. Easy, one might argue, to ramp up advertising and get more people into town, but there’s a serious cost that comes with doing it effectively.

There’s the impact on infrastructure, which many councils are struggling with, along with the direct cost to ratepayers of promotional activity.

When that cost is driving up the rates on farms, themselves pretty good job-generating businesses, questions get asked.

For Ruapehu Federated Farmers, worried about their Council’s proposed new $382k tourism initiative, the release of the Manawatu-Whanganui Economic Growth study offered an opportunity to showcase sheep and beef businesses and raise questions about the rates they pay.

Sheep and Beef, along with tourism, was listed in the Growth Study among the five top economic development opportunities. With the strong feeling that Council’s tourism plans might simply be siphoning money off farms to benefit another industry, Feds sought and got a two-hour audience with council in August to make the farming case.

This included the powerful argument that rating policy and its impacts on existing businesses is every bit as important to economic growth as spending money on promotional strategies. The Feds executive demonstrated the value of employment and careers in the long established sheep and beef sector and argued that, as one of the major opportunities in the Growth Study, the rates on farms in the district should be reviewed as part of Council’s growth strategy.

Here’s hoping this argument can get some traction in 2017 and produce some serious consideration of the rates levels on farms in Ruapehu. Federated Farmers will be watching and waiting.

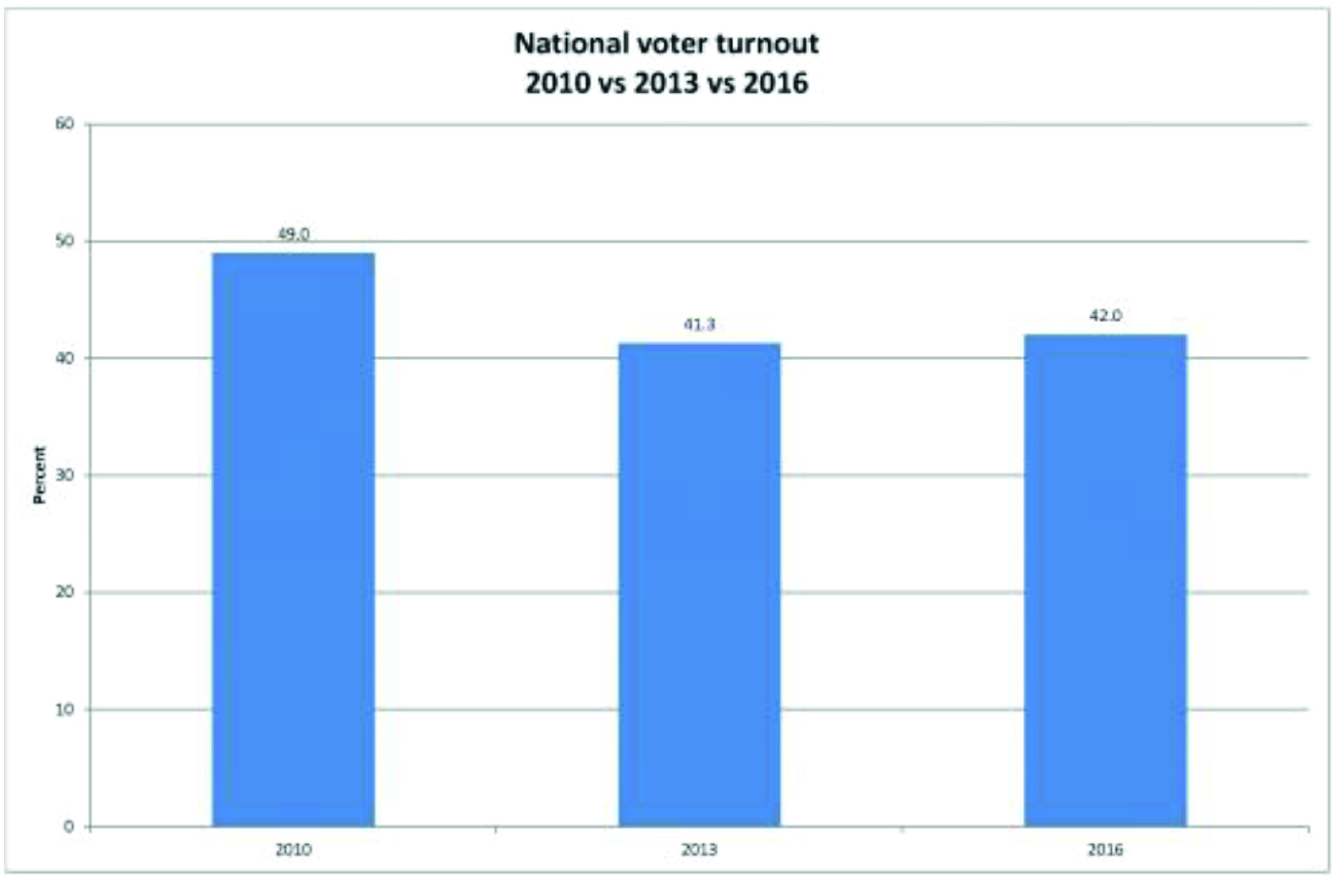

Voter turnout in the 2016 local elections

A low percentage turnout in 2016 has raised the usual questions about voting methodology, but is there a deeper malaise?

The importance of voter turnout was discussed at length leading up to the 2016 local government elections. Federated Farmers added to local debate with a manifesto of policies for farmer candidates to use campaigning, and promoted a number of ‘meet the candidates’ meetings.

Overall however interest in the elections couldn’t be described as intense.

Local Government New Zealand (LGNZ) indicates that overall voter turnout for the 2016 local government elections was, at 42 percent, not far adrift of the 2013 turnout of 41.3 percent.

Both years are still well down on 2010 where turnout was 49 percent, as shown in the graph from LGNZ below:

Source: LGNZ Final voter turnout 2016 http://www.lgnz.co.nz/vote2016/final-voter-turnout-2016/

Coming off such a low base, the 2016 turnout is not the best news for local government which has aspirations of getting involvement back to and beyond 50 per cent.

Why should we care? A lack of voting and engagement undermines the long term viability and mandate of local government. Elections are an important accountability mechanism.

How do we improve things? Commonly discussed options like online voting aren’t ‘silver bullets’ that will recreate interest; what’s needed is a restoration of the conviction that elected governance can make a real difference to costs and what’s delivered.

Within the statistics for 2016 there are some interesting quirks that might count as hope. Voter turnout counts for individual councils, for example, show a real variance.

At the more extreme end of the spectrum, two councils saw voter turnout reduce by over 20 percent between 2013 and 2016, while other councils saw double digit increases in the numbers voting over the same period.

This variability indicates there are a number of different factors driving voter turnout, and further work needs to be done to determine what gets people to the voting booth.

Were the councils with higher voter turnout facing a competition between strong candidates, or a particularly contentious issue? Or have those councils simply engaged better with their communities more generally in the intervening years between elections?

From a rural perspective, there is a consistent tendency for a greater proportion of rural people to vote, at nearly 50 percent, in comparison to metropolitan councils where overall turnout was less than 40 percent.

The relatively greater impact of spending decisions on rural communities and the potential impact of regulation on rural production may play some part in this difference.

Local Government Reform – Where to Next?

It’s back to square one with the Government’s latest attempt to reform local government.

With local opposition stymying amalgamation attempts in Nelson-Tasman, Northland, Hawke's Bay and Wellington, the Government decided a new approach was needed to drive more efficient local government through economies of scale – but without going the ‘whole hog’ with amalgamations.

The enthusiasm for economies of scale put the spotlight on shared services. Although there is a history of councils collaborating on shared services, they have mostly flown under the radar and been for ‘back office’ functions, not the big ticket items.

The Government saw potential for shared services to spread into major infrastructure activities like water and roading where it thinks big savings could be made.

The answer was put forward in a Local Government Act Amendment Bill which sought to put in place a new framework to make it easier for councils wanting to pursue more significant shared services. More significantly though it also gave the Local Government Commission the ability to initiate shared services proposals.

The Bill was introduced in June and is being considered by Parliament’s Local Government and Environment Select Committee.

The Bill has proven to be controversial with strong opposition from many in the local government sector. Some rural councils are worried that if they lost their water and/or roading activities to a regional shared services operator they would lose their reason for existence and it would force amalgamation on them.

At the hearings on the Bill Federated Farmers agreed with the Bill’s intent to make local government more efficient and effective through more shared services. However, we were less keen on Ministerial powers to direct the Local Government Commission on reorganisations and an apparent lack of polls for some reorganisation proposals.

The concerns expressed with the Bill clearly resonated with both the Select Committee and with the Minister so it was no surprise when the Bill’s report back date was pushed out to March 2017 to enable more work to be done.

So where to next? With the Bill’s report back likely to be only months before next year’s General Election there must be long odds on anything bold or radical.

Lower South Island annual plan highlights

Flood and drainage rates, a rural differential kicking in, and rates on

re-zoned land featured in our various submissions in the deep South

In

the lower South Feds has campaigned hard on annual plans over the years

to keep things fair and balanced. In 2016 a few councils chucked a bit

of extra seasoning on the standard annual plan fare. The result was

largely palatable; in other examples a bad aftertaste remains. Otago

Regional Council’s draft annual plan proposed significant rates

increases, something we’d generally take a dim view of. However, in some

cases the rates increases were a result of ORC responding to changes we

had sought in previous years.

These included a reduction in the

contribution required of farmers to the Taieri and Lower Clutha flood

protection and drainage schemes. We had long argued the public benefit

aspect of these schemes was not reflected in the funding and farmers

were paying too much - a view that an independent review ultimately

agreed with.

To their credit ORC implemented the required changes

to funding. The council also listened to our request to eliminate a

proposed $150,000 spend on promotional signs for the Otago region.

Queenstown

Lakes District was another annual plan of interest, on account of a

review of fees and charges which sought to increase user cost recovery.

While agreeing with the intent to reduce the reliance on rates in favour

of user pays, we argued that resource consent processing was too

inefficient to justify increased fees - and that savings could easily be

found. Council proceeded with those increases regardless.

We opposed

Queenstown Council’s proposal to charge higher rates for farming land

that was zoned for residential or rural residential development. This

would have meant a huge rates increase for affected farmers, who also

put their case directly. Fortunately, Council agreed and chose not to

adopt the proposal.

Further South, we had some success with

Invercargill City Council where farmland benefitted from rates decreases

as a result of the work Federated Farmers put into reducing the farming

differential last year.

Waitaki District Council proposed a low

overall rates increase, welcome additional spending on rural roading and

a review of council and regulatory services, all of which we supported.

The

unpalatable component of Central Otago District Council’s annual plan

was felt by farmers in the Vincent Ward. Despite our opposition, council

decided farmers should pay more for ward based community services and

works in the Vincent ward than they had been.

We continue to dispute

Council’s view this is fair and argued Council should accept

applications from farmers for a partial refund of the overall rates

increase. Council are currently considering these applications.

Upper South Island Annual Plans: some handy results

Federated Farmers got some handy rates results in the Upper South Island in 2016

Councils in the Upper South Island are a diverse bunch. They include New Zealand’s second largest city, other urban areas, and rural areas, some of them very remote. There are fast growing councils and councils experiencing population decline, which pose their own challenges around infrastructure and services and how they are paid for. Everywhere there is a growing burden of environmental regulation, especially around freshwater management. This is before considering the earthquake recovery which continues to have implications for Christchurch, Waimakariri and Selwyn in particular (not to mention the most recent quakes – but that’s a story for the future).

Some councils did a great job of consulting on their draft annual plans but others that did not propose significant changes to their Long Term Plans chose not to consult or only did so in an abbreviated manner. This variation in practice was seen around the country.

A number of councils proposed and adopted smaller rates increases for 2016/17 than foreshadowed last year in their Long Term Plans. For example, and not an exhaustive list, Marlborough’s LTP forecast a 5 percent increase which was reduced in the adopted annual plan to 2.5 percent; Tasman was 3 percent down to 1 percent; Grey was 4.2 percent down to 2.9 percent; Christchurch was 7 percent down to 5 percent; Selwyn was 6 percent down to 4 percent; and Ashburton was 4.4 percent down to 3.3 percent.

Although Federated Farmers can’t take direct credit for these shavings of rates increases we are one of the few submitters that consistently advocates for spending restraint and for smaller overall rates increases. Without us there would be less pressure on councils to cut their cloth.

The biggest ‘win’ was Kaikoura District Council’s decision, after considering submissions, to put in place a 0.9 rural differential on the general rate. This was in response to concerns expressed by Federated Farmers on the impact of its district wide revaluation which threatened to impose big rates increases on farms. Savings will depend on the farm’s value but for the Council’s farming example properties there will be savings of between $178 and $327 on what the rates increases would have been.

Christchurch City Council retained its 0.8 rural differential on the general rate. This differential is very important for farmers, especially on Banks Peninsula where farmers are particularly remote from many council services available to people in the urban areas.

Selwyn District Council introduced a district wide rural water rating scheme which we supported as it reduced water rates for many farmers in the district.

Although we got some good outcomes, challenges remain and next year we will be at it again. Keeping rates increases contained and ensuring the rates burden is applied fairly will always our top priorities.

Upper North Island Annual Plans: one for the dogs

A mixed bag, with setbacks on revaluations, ongoing rates assistance in Rotorua, and a long sought break on dog fees

A mixed bag, with setbacks on revaluations, ongoing rates assistance in Rotorua, and a long sought break on dog fees

The impacts of district revaluation were a feature in the North for Federated Farmers this year, with South Waikato and Whangarei districts in particular imposing significant rate increases on dairy farms. Farm rateable values based on 2015 numbers rose in these districts much more than other properties, bringing a larger proportion of the rate take with them.

Federated Farmers in both instances tried to convince council to moderate the increase using their powers to remit rates, particularly in the light of declining dairy farm incomes. From a longer term perspective differentials need to be effectively used so the council can manage rates allocation and not leave it entirely up to the vagaries of valuations.

Sadly, in both cases our requests fell on deaf ears, but our work bringing these cases to light provided a salutary lesson in the absurdity of a tax system ramping up your contribution when your income is shattered.

Elsewhere annual plans were generally business as usual, with plenty of challenges on roading service levels and localised issues such as the funding and rating of rural water schemes.

Most of the rate increases came in under the forecast from the previous year – which is always worth a compliment. We continued our efforts in many districts to retain rating differentials, that manage the rural contribution, and uniform charges where they are used as an alternative to property value rates.

In the Rotorua Lakes district the council decided to continue their policy of remitting a percentage of rates on dairy farms that faced major rate increases last year due to rating policy changes and a big jump in farm values. Local Feds representatives worked hard to get this in place in 2015, and the policy is worth $320,000 to farmers.

Another small gain for the farming community was on dog fees in the Western Bay of Plenty district, where after many submissions over the year’s locals scored a $27 reduction in the registration fee for a working dog. As some luminary once said, nothing in the world can take the place of persistence.

Lower North Island Annual Plans: maintenance and new insights

Transparency, parking, roads and economic development all featured in a variegated range of Annual Plans

There was not much in the way of controversy or major rate increases on farms in this area of the country, but the important themes of transparency and fiscal discipline did arise.

In Hawkes’ Bay Federated Farmers got on to the regional council about the paucity of good rating information in their Annual Plan document, with our submitters unable to identify the extent to which council uses flat uniform charges to support property value rates. There was no commentary on debt either, and significant variations in rural areas on the advertised rate increase of 4.5%.

Hoping for better next year.

In the same region Hastings district council delivered up moderate rate increases on farms within a balanced and well-reported rating system, earning our compliments. A similar situation in Central Hawkes’ Bay. where good use of targeted rates and uniform charges and a reduction in debt earned a fairly positive submission.

Over to the West and of a more urban flavour, we did offer some opposition to New Plymouth’s proposals to provide free Saturday parking in the CBD and upgrade pool and events centres. The message came from farmers under financial strain wanting to see some belt tightening from the council. The message partly got through, with the free parking adopted as a twelve month trial instead of a permanent policy.

Horizons Regional Council is always a big focus, particularly with the release of the Accelerate 25 economic development programme and a number of more local catchment concerns. We are seeking a coordinating role for the council, as opposed to something more direct on the Accelerate 25 programme.