Economic Week - December 7

by Nick Clark

Commodity prices slip again

In November the ANZ World Commodity Price Index fell for a sixth consecutive month. The monthly decline of 0.6% was smaller than the previous months’ falls but the index is now 5.3% lower than a year ago.

Dairy prices fell 1.7% for the month and were down 9.2% for the year. They are at the lowest level since August 2016.

The meat and fibre index lifted 1.1% for the month but remains 3.7% down for the year. Beef prices lifted 2.4% during the month but are still 13.4% down on a year ago. Lamb prices lifted 1.2% during November and are up 7.4% for the year. Wool prices slipped though, down 5.1% for the month to be down 6.9% for the year.

The fall in world prices was accentuated by a stronger NZ Dollar, which was up 3.4% for the month on a trade-weighted basis. This saw the NZD index down 4.4% for the month. Annual growth in the NZD index also slipped into negative territory for the first time since October 2016, down 4.2% for the year.

Terms of trade falls

Rising petrol and diesel prices in the September quarter pushed import prices up more than export prices, leading to a 0.3% fall in the terms of trade, according to Statistics NZ’s quarterly Overseas Trade Indexes.

The terms of trade measures the purchasing power of our exports abroad and is an indicator of the state of the overall economy. It declined despite overall export prices reaching their highest level in almost a decade.

The rise in import prices, up 2.6% in the quarter, was led by a 6.4% increase for petroleum and petroleum products. Export prices rose 2.3%, with dairy prices up 6.5% and meat prices up 1.9%.

GDT rises

This week’s auction saw the Global Dairy Trade record its first gain for the 2018/19 season.

Overall, the GDT Price Index was up 2.2% on the previous auction a fortnight ago. Almost all commodities on offer posted rises, with cheddar being the only to fall, slipping 2.2%. The biggest products by volume all posted rises with whole milk powder up 2.5%, skim milk powder up 0.3%, anhydrous milk fat up 3.9% and butter up 2.7%.

The average selling price was $US2,819 and 36,450 tonnes were sold.

This week’s auction saw the first rise in the GDT Price Index since the auction on 15 May. In the period up to this auction there were 11 losses and one no change result.

Despite this week’s increase, the GDT Price Index remains 18.8% below where it stood on 15 May and is 11.1% below where it stood at the same time last year.

Fonterra reduces forecast

Despite this week’s increase in the GDT, the long run of falling dairy prices since May has prompted Fonterra to again cut its forecast milk price.

This week Fonterra revised its 2018/19 forecast Farmgate Milk Price range from $6.25-$6.50 per kgMS to $6.00-$6.30 per kgMS. The cut comes after a bigger cut two months ago. On a brighter note it maintained its forecast earnings per share range of $0.25-$0.35.

Fonterra cited the global milk supply remaining stronger relative to demand as the key reason for lower commodity prices and therefor a lower farmgate price.

However, Fonterra shares the view of other commentators who expect international dairy prices to firm across the balance of the season as some of the factors boosting supply relative to demand begin to unwind.

An El Nino weather pattern affecting New Zealand milk production is a possibility. So, despite a strong start to 2018/19 milk production Fonterra is maintaining its previous forecast for season collections of 1,550 million kg MS.

Ag debt creeps up

Agricultural debt increased slightly to $62.3 billion in October 2018, according to the Reserve Bank’s monthly Sector Credit Statistics. This is up $61 million on September 2018 and $1.7 billion (or 2.8%) on October 2017.

Agriculture’s 2.8% annual growth in debt continues to be slower than those for housing (up 6.0%), personal consumer (up 3.6%) and business (up 5.8%) sectors.

Rates on the rise

Statistics NZ’s quarterly Local Authority Statistics show local authority rates income grew to $1.5 billion in the September 2018 quarter, up 6.2% on the same quarter last year. For the full year ended September 2018 rates income was $5.9 billion, up 5.0% on the year ended September 2017.

Council operating spending also grew to $2.7 billion in the September 2018 quarter, up 7.3% on the same quarter last year. For the full year ended September 2018 operating spending was $10.6 billion, up 5.6% on the year ended September 2017.

Growth rates for both rates income and operating spending have accelerated compared to previous years.

The Productivity Commission’s Inquiry into Local Government Funding and Financing has a job on its hands.

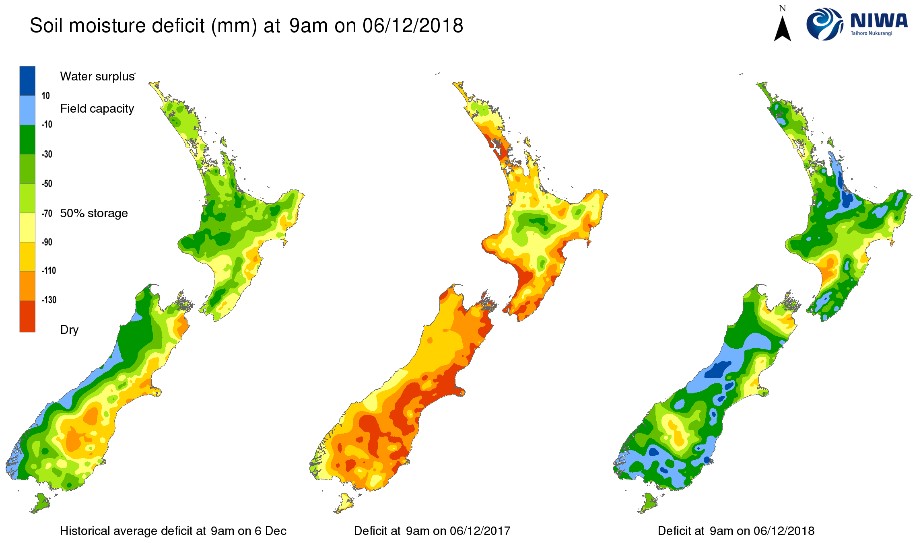

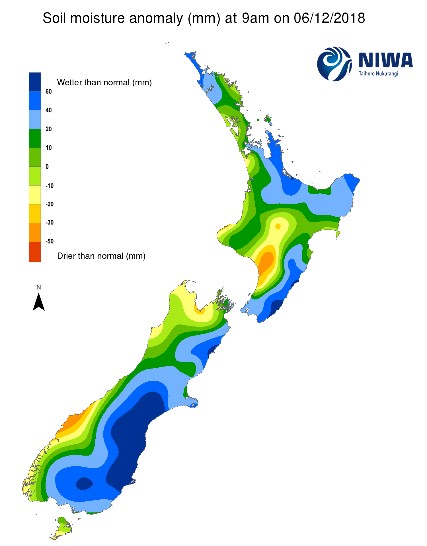

NIWA Soil Moisture Data

NIWA’s latest soil moisture maps (as at 9am Thursday 6 December) show a strong contrast between current conditions and the very dry conditions which prevailed across most of the country at the same time last year. Compared to historic averages much of the country’s soils are wetter than usual.

Exchange Rates

Over the course of the week the NZ Dollar was up slightly against the Trade Weighted Index and was also up against most of our main trading partners, except the Yen (basically unchanged) and Chinese Renminbi (down slightly).

|

NZ Dollar versus

|

This Week

(6/12/18)

|

Last Week (29/11/18)

|

Last Month (6/12/18)

|

Last Year (6/12/17)

|

|

US Dollar

|

0.6883

|

0.6843

|

0.6663

|

0.6884

|

|

Australian Dollar

|

0.9501

|

0.9376

|

0.9239

|

0.9083

|

|

Euro

|

0.6064

|

0.6020

|

0.5839

|

0.5824

|

|

UK Pound

|

0.5410

|

0.5336

|

0.5102

|

0.5131

|

|

Japanese Yen

|

77.70

|

77.71

|

75.48

|

77.41

|

|

Chinese Renminbi

|

4.7253

|

4.7601

|

4.6148

|

4.5522

|

|

Trade Weighted Index

|

75.12

|

74.84

|

72.96

|

72.87

|

Source: Reserve Bank of NZ

Wholesale Interest Rates

The 90-day Bank Bill rate was unchanged for the week but the 10-year Government Bond retreated 13 basis points (after falling by 9 basis points the week prior). The OCR has been unchanged on 1.75% since November 2016.

|

|

This Week

(6/12/18)

|

Last Week (29/11/18)

|

Last Month (6/12/18)

|

Last Year (6/12/17)

|

|

OCR

|

1.75%

|

1.75%

|

1.75%

|

1.75%

|

|

90 Day Bank Bill

|

1.98%

|

1.98%

|

1.96%

|

1.90%

|

|

10 Year Government Bond

|

2.49%

|

2.62%

|

2.64%

|

2.77%

|

Source: Reserve Bank of NZ